There was eager anticipation for a new US labor market report. And not only because the flow of macro data from the United States is still lagging as a result of the shutdown. The US labor market is what can still obscure the real reason why rates were cut by another quarter point. But that argument does not hold either.

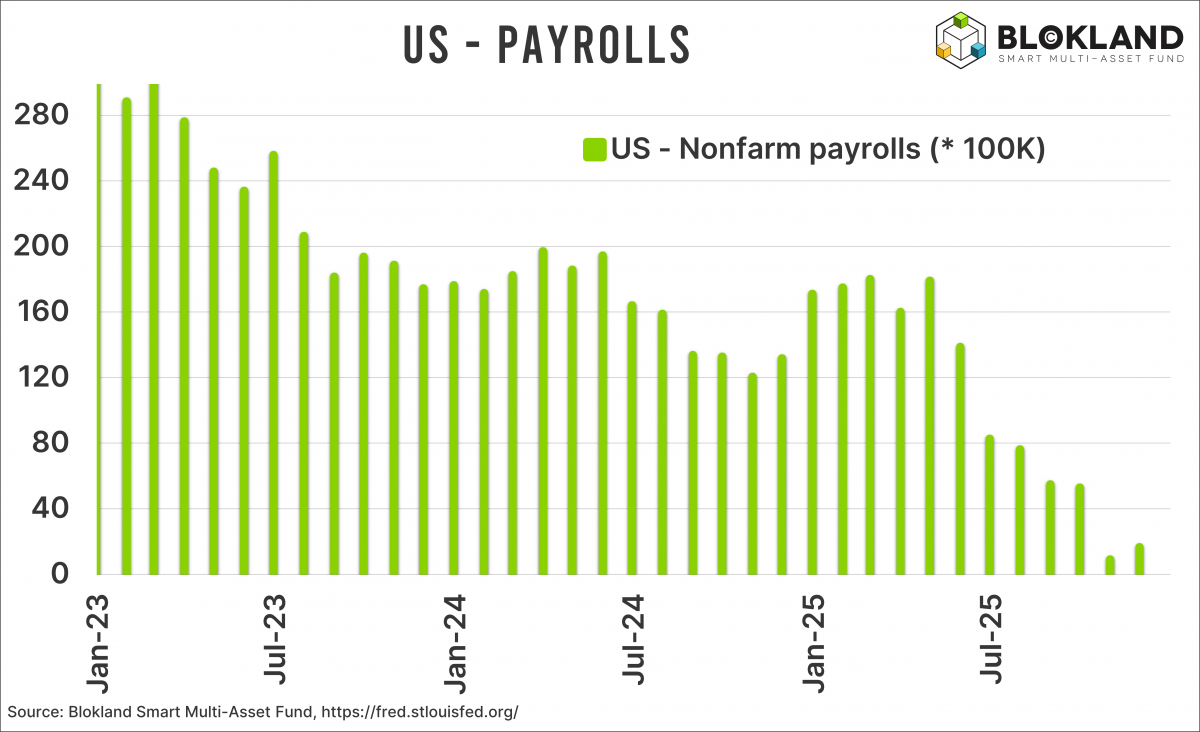

According to the Bureau of Labor Statistics, 64,000 jobs were added in the United States in November. An improvement compared with October, when more than 100,000 jobs were lost. Over the past four months, average job growth has been just 10,000 per month. Practically zero.

A stagnating labor market is, of course, not good news. And with a dual mandate that, alongside inflation (still too high, incidentally), also calls for maximum employment, a rate cut is easy to justify.

Dissonance

Still, not every Fed member agreed. Two of the voting members would have preferred to leave rates unchanged. The third dissenter was Trump, sorry, I of course mean Miran, who had a 0.5 percent rate cut in mind.

Incidentally, those three dissenters made the headlines as expected, because this was the highest number since 2019. The truth, however, is also that if you go by all the “Fed speak” in the run-up to the rate decision, the number of dissenters was considerably smaller than expected.

That raises even more questions about the political independence of the Federal Reserve. We know from Trump that he will award the Fed chairmanship to whoever promises him the lowest rate. But loudly proclaiming that you oppose a rate cut only to then cheerfully vote along anyway also strikes me as just a bit too tactical.

Population decline

I am drifting away from the message I want to convey here. Namely, that US job growth is far less worrying than the reporting would have you believe. According to Trump, around 2.5 million undocumented immigrants, affectionately referred to as “illegal aliens,” are leaving the United States this year. At the same time, (illegal) immigration has more or less come to a standstill, according to the president.

Now, the man does have a tendency to exaggerate, but various institutions point out that 2025 could well be the first year in a very long time in which net immigration is negative. And, moreover, that the US population is not growing, or barely growing at all.

Fallacy

You can probably feel where this is heading by now: if the population is not growing, how many jobs are really needed? To ask the question is to answer it. Now, unemployment has also risen this year, so maximum employment cannot be said to apply, and from this perspective there is room for a more accommodative monetary policy.

But the argument that rates, given inflation of 3 percent, need to be cut because of the labor market is flimsy at best. If you deliberately choke off population growth, you need far fewer additional jobs. And as the chart shows, the six-month average of job growth has not been negative a single time.

Puzzle pieces

While point estimates for GDP growth and the S&P500 index are pouring in, the current central bank dynamics seem somewhat underexposed. The Federal Reserve cuts rates, has another one penciled in for next year, will soon get a chair who sees rates at 1 percent, buys short-term Treasuries under the heading of reserve management (we are really not allowed to call it QE), thus expands the balance sheet, and at the same time sees long-term rates shoot higher.

There is really only one word that fits: inflation. While most investors assume lower inflation (certainly possible in the short term), a new inflation wave cannot be ruled out. And the Federal Reserve is happily contributing to this. But then again, it has been clear for some time that price stability is certainly not number one on the list of monetary objectives.

But if that inflation were to show up before the US midterm elections, then Trump, who is already not doing particularly well, can forget about holding on to the Senate.

Jeroen Blokland analyzes striking, topical charts on the financial markets and macroeconomy. In addition, he is manager of the Blokland Smart Multi-Asset Fund, a fund that invests in equities, gold, and bitcoin.