With a new Fed chair on the way, subject to approval by the U.S. Senate, it seemed like a good moment to take another look at “inflation.” And especially at inflation expectations, because they largely determine the behavior of consumers and investors alike. What I see is far from reassuring.

Since the coronavirus crisis, the concept of inflation has become severely diluted. Quite apart from the fact that inflation is essentially synonymous with an expansion of the money supply, something many investors were never explicitly taught (it took me a while as well), dozens of definitions of price increases are now circulating, applied with a certain degree of arbitrariness.

The Federal Reserve itself set a poor example. The series of inflation definitions it introduced more than five years ago, and which you hardly hear about anymore today, has significantly blurred the playing field. As soon as the Bureau of Labor Statistics publishes the official inflation figures, an explosion of posts on X and Linkedin inevitably follows, each time emphasizing yet another inflation measure or time period. Every month, there is something for everyone.

Crystal ball

I am personally most interested in inflation expectations, simply because they drive the vast majority of the behavior of investors, central bankers, and consumers. The University of Michigan is also aware of the fault line that emerged after the pandemic. Every quarter, the institute publishes an update of its report Current versus Pre-Pandemic Long-Run Inflation Expectations, which explicitly examines inflation expectations before and after the pandemic.

The main conclusion is clear: long-term inflation expectations have by no means normalized. The median expectation currently stands at 3.3 percent, significantly higher than before corona and comparable to the levels of 2023. You read that correctly: 2023.

Extremely high

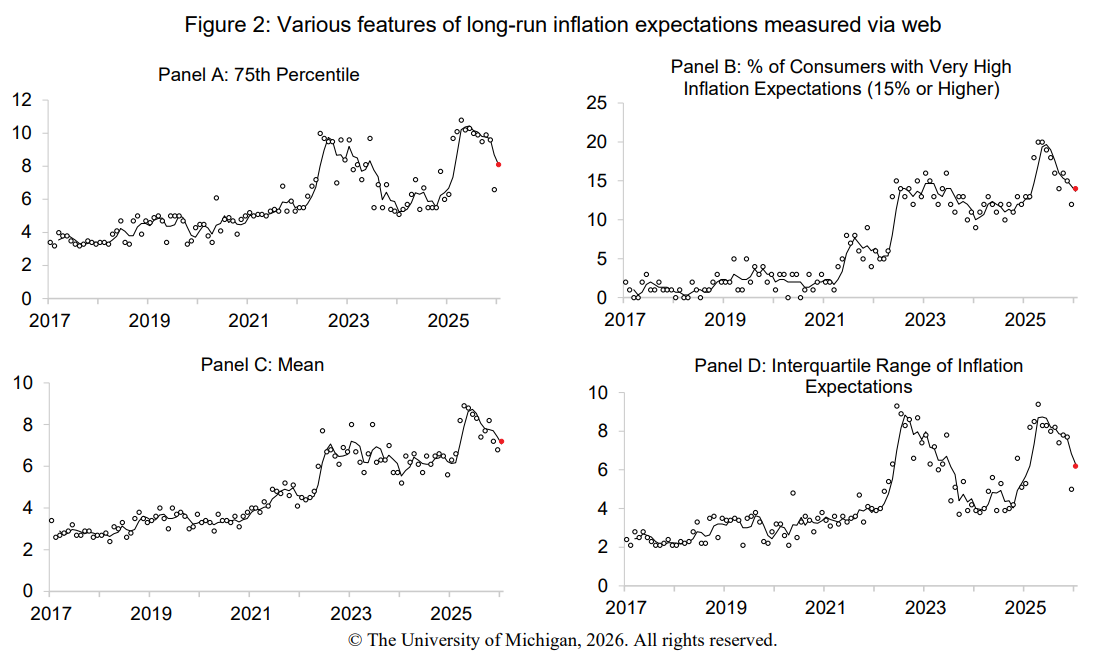

Below are four charts from the most recent update of this study. They reveal several additional striking observations. The average (not the median) inflation expectation (Panel C) is even above 7 percent, suggesting that a large group of American consumers expects extremely high inflation.

Panel B provides the evidence. Just under 15 percent of respondents, roughly one in seven, expect inflation of 15 percent or higher. Before corona, this figure was barely 2 percent. It seems evident to me that people who expect 15 percent inflation behave and invest fundamentally differently from those who assume a moderate level of inflation.

The message from the University of Michigan data is therefore clear: inflation expectations are at the level of 2023, or even higher. And this while, over the past two years, we have continuously been forced to listen to the word disinflation, often presented as an argument for sharply cutting interest rates.

In a recent newsletter of my investment fund, I already wrote that inflation in the Netherlands has normalized. Companies, hairdressers, restaurants, shopkeepers, at the end of the year they invariably come with the same message: “Prices are going up, because, well, inflation.” In the United States, this is no different. Price increases have become normalized, with extremely high inflation expectations as the logical consequence.

Smoke screen

Fortunately for central bankers, there is always an inflation measure to be found that fits the desired narrative. For example, I see that the three-month annualized Atlanta Fed Core Sticky CPI excluding Shelter (sound familiar?) came in at just 1.15 percent at the end of December. Eureka.

If Kevin Warsh truly is such a pronounced inflation hawk, then let him start by choosing one clear measure that we can stick to. And even then, he still has to contend with the other FOMC members, most of whom only chose to raise rates once the regular inflation figure had already reached 8 percent.

Jeroen Blokland analyzes striking, current charts on the financial markets and the macro economy. In addition, he is the manager of the Blokland Smart Multi-Asset Fund, a fund that invests in equities, gold, and bitcoin.