Financial markets are under pressure. Not only stocks but also other asset classes are mostly moving lower. Are we dealing with unique factors, or is there a single overarching culprit?

If you invest in bitcoin, you are asked constantly what exactly caused bitcoin to drop 10 or 20 percent (yet again). That is striking in itself, because in the most volatile category in the universe you really should not be surprised when a sharp loss shows up in a short period of time. I am amazed every time by the ongoing silence around bonds, which also this year—the fifth in a row—have failed to deliver any meaningful return. And yet they still make up roughly 40 percent of those so-called “well-diversified” portfolios.

Pointing fingers

The truth is that in recent weeks stocks, gold, bitcoin and crypto have all performed poorly. The price of oil has also been trending lower for quite some time. That raises the question of whether all those “logical” explanations per asset class are actually that logical. Investors stubbornly keep thinking in boxes, firmly believing their own asset is always the best. Stocks are too expensive, gold has gone too far, bitcoin is suffering from selling whales, and more and more crypto companies are distancing themselves from “crypto” altogether (focusing solely on bitcoin, which I can understand).

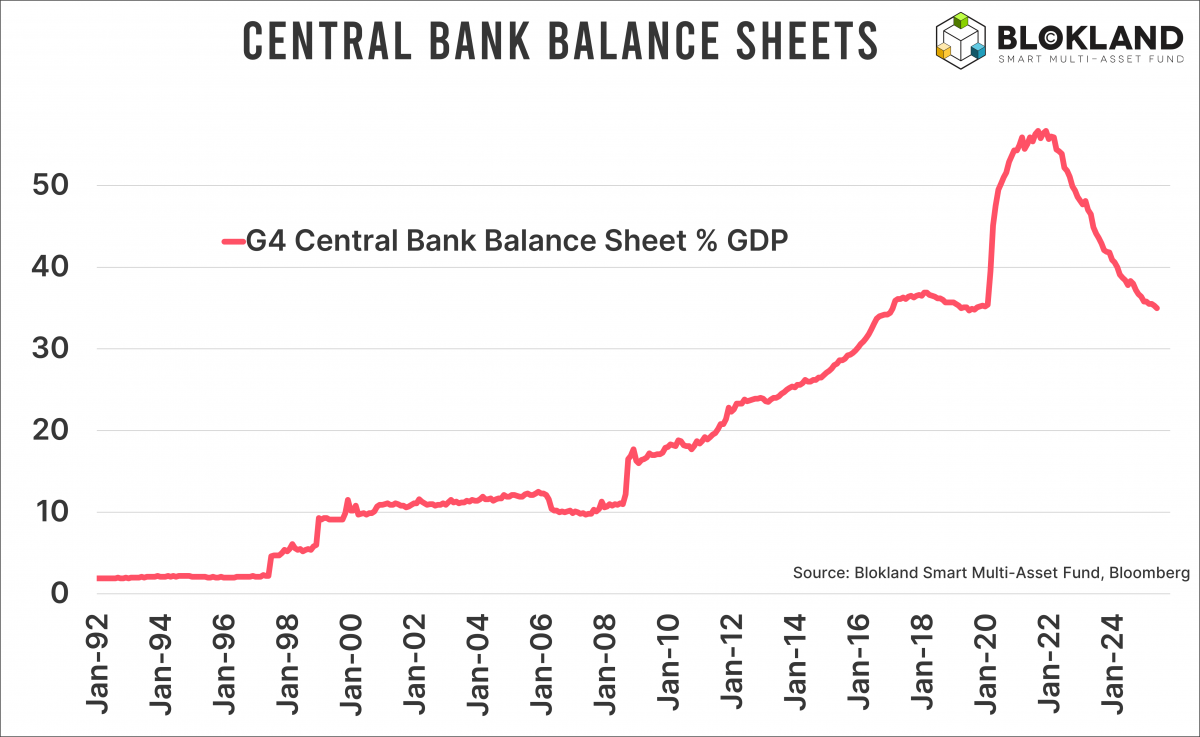

There are plenty of pointing fingers, but it seems likely that investors are overlooking, or at least undervaluing, an overarching factor. That factor is liquidity. Central banks that stop reducing their balance sheets even though inflation is still clearly above the 2 percent target. Central bankers pushed forward en masse to explain that an abundance of money must remain in the system for that system to function properly.

Cockroaches

These are just two examples of the increasingly loud calls for more liquidity. Those wonderful little private-debt funds, where one cockroach—that is the current buzzword—after another keeps crawling out of the cupboard. Private-debt fund managers are quick to insist that it is all not that bad. Yet another example of how asset managers’ love for their own asset class makes them completely blind. But the opposite is true. Where do things go wrong with such loans? Precisely when they cannot be rolled over or refinanced. And what is needed for that? A whole lot of liquidity.

It is rather convenient that for all these problems, private equity and private debt have become so “democratized”. In other words: the everyday retail investor ends up footing part of the bill. Always nice when you can exploit such a massive information advantage.

Refinancing machine

Let me not dwell too long on those two “definitely not so great investments”. Liquidity problems now pop up at the slightest trigger, the result of an ever-growing mountain of debt that must be refinanced again and again.

When liquidity is abundant, part of it finds its way into other investments such as stocks and bitcoin. Those one-day options and hardcore bitcoin speculators need something to play with, after all. The fact that gold is also under pressure confirms that liquidity is the prime suspect behind the decline in a large set of markets.

To the rescue

Fortunately, since the Great Financial Crisis central banks are fully aware of this dynamic. What they struggle with is how to say this out loud without admitting that the inflation target has become less important. That obviously does not fit with their independent status.

I expect a global liquidity impulse from central banks in 2026. That makes things like stock valuations, wandering whales, and so on just a bit less important. In a debt-driven economy, liquidity is ultimately the only thing that matters.

Jeroen Blokland analyzes striking, current charts on financial markets and macroeconomics. He is also the manager of the Blokland Smart Multi-Asset Fund, a fund that invests in stocks, gold and bitcoin.