Europe’s anti-money laundering frameworks remain among the most comprehensive in the world, but weaknesses in enforcement and declining financial transparency continue to hold back their effectiveness. That is one of the conclusions of the Basel AML Index 2025, which points to persistent gaps between regulation and outcomes in practice.

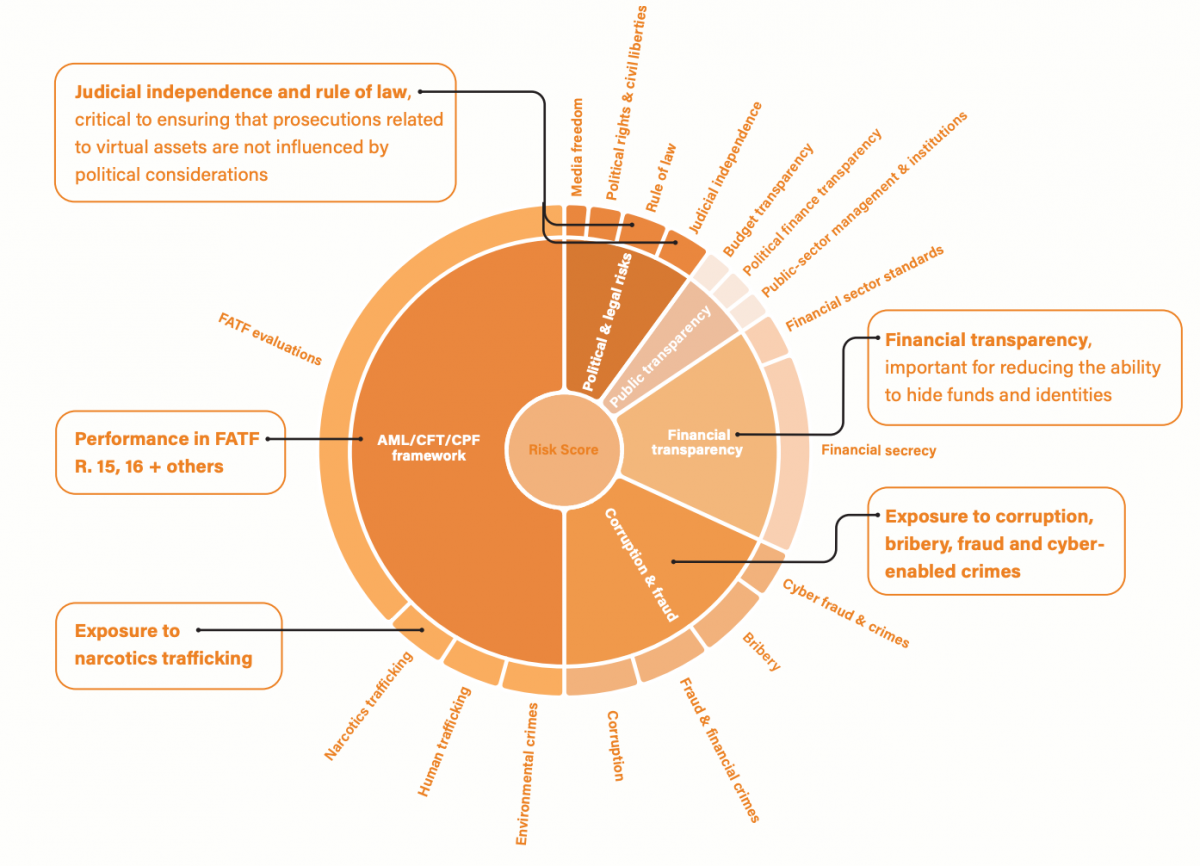

The annual index, published by the Basel Institute on Governance, measures vulnerability to money laundering and related financial crime across 177 jurisdictions. Each country receives a score on a scale from zero to ten, with higher scores indicating higher risk. The assessment combines indicators covering AML legislation, corruption, financial transparency, public accountability, and political and legal risks. Supervisors and many private banks use the index as a reference when assessing country-related AML risks of clients.

“The gap between technical compliance and effectiveness have been observed globally.”

Kateryna Boguslavska, Basel AML Index

Globally, the risk picture changed little in 2025. The average score improved slightly, from 5.30 to 5.28. According to the Basel Institute, this points to broad stability at the global level, although without a corresponding improvement in the effectiveness of AML regimes.

“The gap between technical compliance and effectiveness have been observed globally,” Kateryna Boguslavska, project manager of the Basel AML Index, told Investment Officer. She added that shortcomings were found in investigation and prosecution, transparency of beneficial ownership, preventive measures as well as quality of supervision.

Legislation alone does not determine outcomes, she said. Factors such as financial transparency, judicial independence, media freedom and civil liberties also influence whether AML measures work in practice. These elements are incorporated into the index’s composite risk scores.

Most of EU is lower-risk

Based on headline scores, most countries in the European Union and Western Europe fall into the lower-risk category. The Netherlands scores 4.53 and Belgium 4.46, while France and Luxembourg score 3.99 and 3.97 respectively. All four remain below the 4.70 threshold used by the Basel Institute to define the lower-risk group.

Germany moved into the medium-risk category this year, with a score 4.79, up from 4.63 in 2024. The country now ranks among the seven EU countries in the medium-risk category, together with to Hungary, Bulgaria, Malta, Romania and Cyprus and Italy. The Basel Institute said roughly 40 percent of European jurisdictions received worse scores than last year. “While most remained in the same risk category, their worsening scores suggest that historically strong performers may now be stagnating or slipping back,” it said.

Risk-based compliance

The Basel Institute this year emphasized proportionality and the risk-based approach to AML supervision. Regulators increasingly encourage banks to align compliance efforts with actual risk exposure, rather than applying uniform controls across all clients and jurisdictions.

“When we identify lower-risk situations, that is where we can apply simplified, proportionate measures, and that is key for financial institutions,” Boguslavska said.

In practice, many institutions struggle to assess lower-risk situations with sufficient confidence. To support implementation, the index now groups countries into low, medium and high-risk bands using data-driven “natural breaks”, replacing static classifications.

Recent guidance from the Financial Action Task Force reinforces this proportional approach. For private banks and wealth managers, this means focusing on specific vulnerabilities, such as corruption risks or opaque ownership structures, rather than de-risking entire regions.

Financial transparency deteriorates

Within Europe, the most notable deterioration concerns financial transparency. According to the Basel AML Index, this domain weakened more than any other in 2025. A key factor has been the restriction of public access to beneficial ownership registers following a 2022 court ruling in Luxembourg. As a result, registers established under EU law to combat money laundering and tax evasion remain closed or only partially accessible in several member states.

The trend is confirmed by the Financial Secrecy Index 2025, published by the Tax Justice Network, which reports a decline in access to beneficial ownership information across Europe.

In its latest ranking, Luxembourg, Germany and the Netherlands place fifth, sixth and seventh respectively among the world’s largest secrecy jurisdictions. Belgium and France rank closer to 30th. According to the Tax Justice Network, EU member states together account for around 21 percent of global offshore secrecy services. The U.S. and Switzerland top this ranking.

Indicators used for the Basel AML Index

Source: 2025 Basel AML Index.