ESG investment funds in Europe have sharply increased their exposure to defense stocks, according to new Morningstar data that offers the most comprehensive look yet at how sustainable finance is responding to geopolitical pressure.

The findings come from Morningstar’s Q2 2025 SFDR report, which offers the first data-driven insight into how ESG-labeled funds are responding to recent EU defense policy shifts.

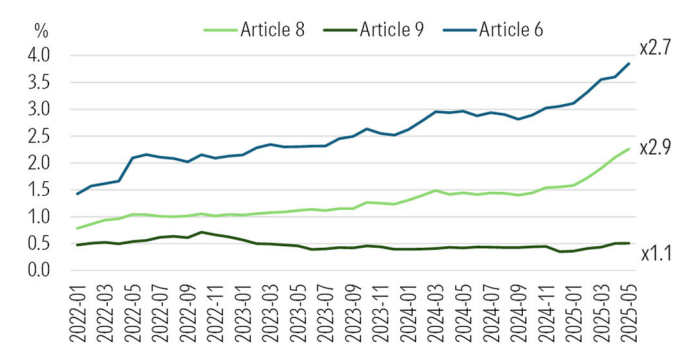

Active Article 8 European equity funds, classified under the EU’s Sustainable Finance Disclosure Regulation as promoting ESG characteristics, quadrupled their average exposure to aerospace and defense stocks, from 0.6 percent in 2022 to 2.5 percent as of June 2025. That narrowed the gap with Article 6 funds, which now average nearly 4 percent exposure to the sector.

In contrast, Article 9 funds, the most restrictive ESG category under SFDR, have largely maintained near-zero exposure to defense stocks throughout the period.

Ukraine war reshaping boundaries

“Since the start of the war in Ukraine in 2022, it has become increasingly clear that geopolitics plays a more significant role in shaping the boundaries of sustainable investing than ethics,” said Hortense Bioy, head of sustainable investing research at Morningstar Sustainalytics in response to an Investment Officer question.

“Asset managers are navigating a rapidly evolving and increasingly complex landscape, where both regulatory and ethical frameworks seem to shift every two years. This environment can be confusing for sustainability-focused investors. As a result, while some choose to stay the course, others are reassessing their investment strategies, often out of concern that rigid adherence to sustainability principles could come at the expense of financial performance.”

Political backdrop

Morningstar’s is the first comprehensive dataset available since the European Commission updated its guidance in March. At that time, Brussels launched the ReArm Europe initiative, pledging up to 800 billion euros by 2030 to bolster the EU’s defense capabilities. The Commission also clarified that investments in defense companies could be compatible with ESG mandates, provided they do not violate international law.

The shift has sparked policy discussions and diverging interpretations among asset managers. Until now, the conversation had largely relied on anecdotal evidence, with only a few asset managers speaking out publicly. Morningstar’s report brings a much-needed empirical basis to the debate.

Market performance matters

Over half—54 percent—of Article 8 European equity funds now hold some exposure to defense stocks, up from 33 percent in 2022. Nineteen percent of those funds now allocate more than 5 percent of their portfolios to defense, up from just 3 percent three years ago.

Passive ESG funds, constrained by index exclusions, saw more modest increases.

Exposure among passive Article 8 funds rose from 0.2 percent to 1.2 percent, reflecting index limitations and the rising valuations of defense stocks.

Part of the rise is due to the sector’s market performance. Morningstar’s European Aerospace & Defense Index soared 249 percent between January 2022 and June 2025, far outperforming the broader European market, which gained 26 percent over the same period. The U.S. defense sector rose 78 percent during that time.

Fund managers divided

Policy has also played a decisive role. In recent months, several large asset managers, most notably Allianz Global Investors, UBS, and DWS, have told clients they have relaxed exclusion policies on military equipment and nuclear weapons for their Article 8 funds. Allianz GI emphasized at a press event in May that such investments are now “eligible” for inclusion but still not counted as sustainable.

Weapons exclusions

Morningstar also tracked fund-level policies on weapons exclusions. It found that 92 percent of Article 8 and Article 9 funds now formally exclude controversial weapons such as chemical or biological arms, up from 76 percent and 89 percent, respectively, in 2022. However, only 31 percent of Article 8 funds and 48 percent of Article 9 funds report excluding companies involved in broader military contracting. By comparison, just 2.5 percent of Article 6 funds apply such exclusions.

Actual involvement levels show a similar pattern. Article 8 funds have nearly tripled their exposure to military contracting and controversial weapons since 2022, though they still remain 40 to 50 percent below the exposure levels found in Article 6 funds.

Popular defense stocks

Among the most commonly held defense companies in ESG-branded European equity funds are aerospace and defense contractors such as Thales, Rheinmetall, and Leonardo, all of which generate more than 50 percent of their revenue from military contracting.

These firms are frequently flagged by ESG data providers for their involvement in weapons production, including controversial weapons like nuclear missiles. Yet they continue to feature in Article 8 portfolios, particularly those that have softened their exclusion criteria in recent months.

Other widely held firms are Safran, Airbus, and Rolls-Royce. These derive a smaller portion of their revenue, typically less than 25 percent, from defense-related activities. Their broader industrial profiles and medium ESG risk ratings have made them more palatable to sustainability-oriented investors.

(This article was updated to include a quote from Hortense Bioy in the fifth and sixth paragraphs.)

Average involvement in military contracting - European equity funds

Source: Morningstar Q2 SFDR report 2025

Related articles on Investment Officer:

- Allianz GI lifts ban on defence stocks in ESG push

- Investing in defense and ESG: three perspectives, no consensus

- ESG funds hesitant about investing in defense