In a year marked by political divergence on climate, Morningstar compares two Article 8 high-yield bond funds navigating Europe’s evolving ESG landscape: Aberdeen Investment’s Abrdn Euro High Yield and Columbia Threadneedle European High Yield.

The year 2025 marks a turning point for investors who consider sustainability and ESG factors as central to their investment decisions. In January, US president Donald Trump withdrew the United States from the Paris Agreement, the global accord to reduce greenhouse gas emissions and address climate change. In contrast, Europe reaffirmed its commitment to achieving climate neutrality by 2050.

For European investors, the Sustainable Finance Disclosure Regulation remains the key framework for categorising sustainable investment products. Funds are classified under Article 6, 8 or 9. In 2024, Article 6 and 8 funds attracted inflows, particularly in fixed income, while Article 9 funds saw net outflows, especially in equities. That trend continued in the first half of 2025, as regulatory uncertainty and weak performance weighed on Article 9 strategies.

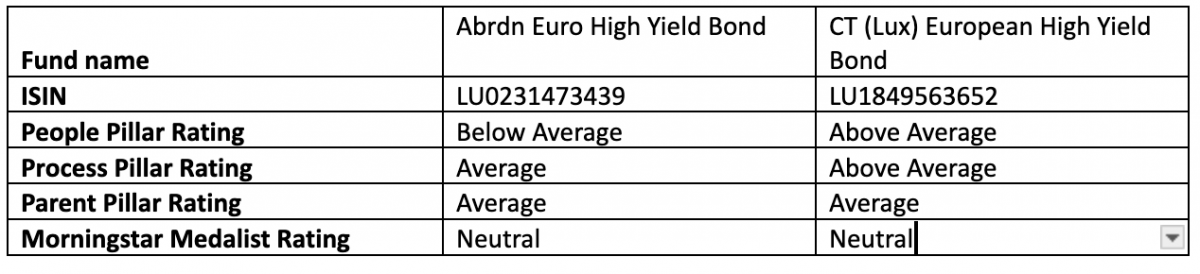

People

The Aberdeen strategy underwent significant staff turnover. Former lead manager Ben Pakenham departed in November 2024, followed by comanager Adam Tabor and two senior credit analysts. Only senior analyst Paul Bateman remained. Abrdn brought back Steve Logan, who had previously led the strategy from 2014 to 2020. While the team has been rebuilt, questions remain about its stability and cohesion. Morningstar assigns the strategy a Below Average People Pillar rating.

Columbia Threadneedle’s European high-yield team is led by Roman Gaiser, head of fixed income, who has managed the strategy since 2019. He has been with the firm since 2005, apart from a seven-year period at Pictet as head of EMEA high yield. Co-manager David Backhouse has been on the team since 2003. Portfolio managers Gareth Simmons and Abigail Mardin, who joined in 2019 and 2024 respectively, add further support. With six dedicated high-yield analysts, the team is experienced and stable. The strategy earns an Above Average People Pillar rating.

Process

Aberdeen previously used a collaborative model, where buy and sell decisions were made as a group. Under the new structure, portfolio managers now lead construction decisions, while analysts continue to rate issuers based on credit fundamentals, ESG factors and relative value. The framework remains disciplined, but given the recent changes, the strategy receives an Average Process Pillar rating.

Columbia Threadneedle follows a bottom-up security selection approach. Gaiser and Backhouse meet twice a week with the analyst team to review holdings and discuss new opportunities. ESG factors are embedded in the credit process through materiality scores, risk assessments and direct engagement with issuers. The strategy is rated Above Average on the Process Pillar.

Portfolio

The Aberdeen portfolio holds between 120 and 140 issuers and uses the ICE BofAML Euro High Yield Constrained Index as a benchmark. Up to one third of the portfolio may be allocated off-benchmark. Historically, around 15 percent has been invested in UK high yield. Under Pakenham, the strategy avoided subordinated bank debt. However, Logan introduced an allocation of around 5 percent to Additional Tier 1 instruments by March 2025, focused on national champions such as Barclays and Deutsche Bank. Exposure to the auto sector was reduced due to concerns over US tariffs and increased electric vehicle competition.

Columbia Threadneedle’s portfolio typically holds 160 to 180 issuers. Active weights are modest, generally between 0.5 and 1.5 percentage points, to reduce single-name risk. The strategy tracks the ICE BofAML Euro High Yield ex Subordinated Financials Index, reflecting its stance against exposure to subordinated debt due to regulatory risk. It focuses primarily on cash bonds.

The Article 8 designation has not significantly constrained either fund’s investable universe. Exclusions typically limit each strategy by less than 4 percent relative to their respective benchmarks.

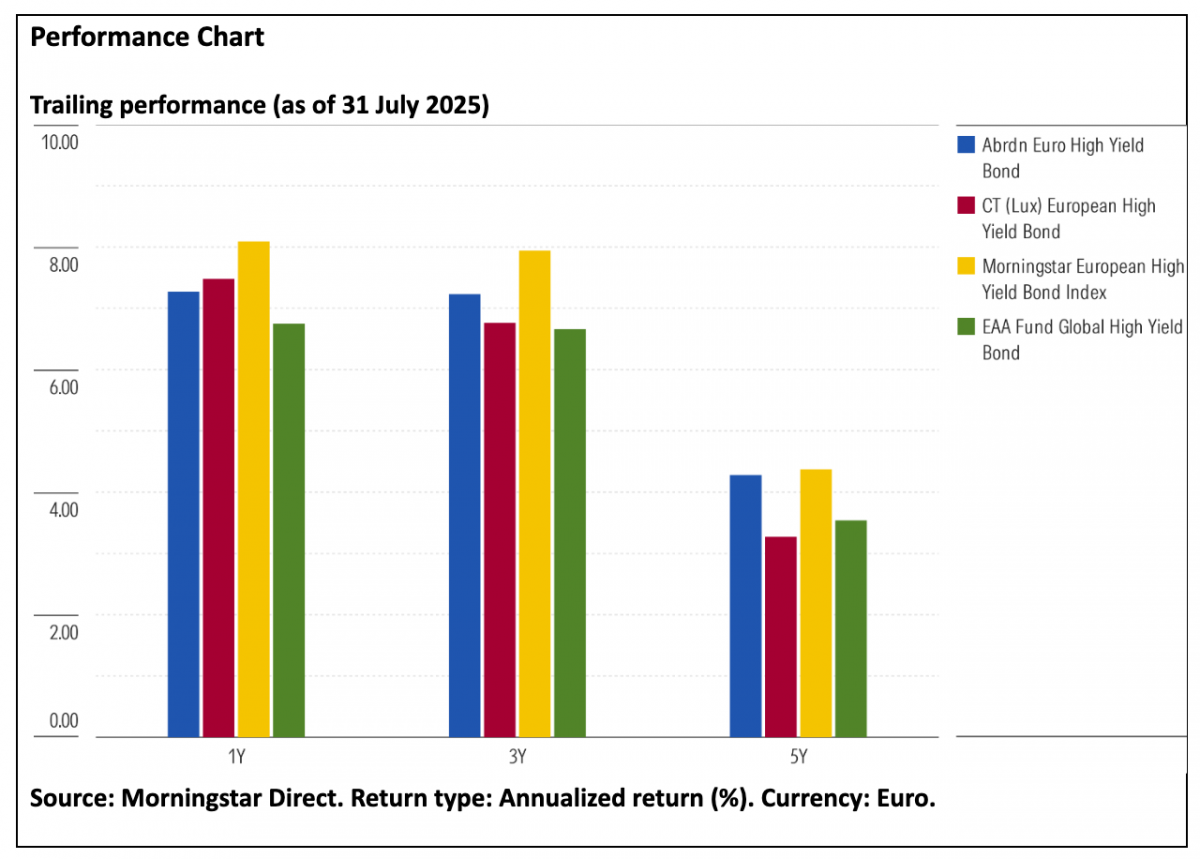

Performance

Aberdeen performed strongly under Pakenham’s leadership from October 2020 to October 2024. The fund’s Article 8 status did not prevent it from maintaining an overweight in the energy sector, which helped limit losses during the 2022 market selloff following the Russian invasion of Ukraine. However, performance lagged in 2024 as the fund steered clear of most real estate names on governance concerns, missing out on the sector’s rally.

Columbia Threadneedle has delivered a smoother return profile than its benchmark and strong risk-adjusted returns over the cycle. The Article 8 label has not materially constrained performance. The team’s decision to limit exposure to Pemex in 2021 held the fund back relative to its UK sibling, which benefited from the Mexican oil giant’s rally.

Abrdn Euro HY vs Columbia Threadneedle European HY

Jeana Marie Doubell is investment analyst fixed income EMEA at Morningstar. Morningstar is a member of Investment Officer’s panel of experts.