Allianz Global Investors and JP Morgan Asset Management take different paths to multi-asset income: one prioritises yield, the other favours balance. Morningstar compares their approach.

Some investors seek regular payouts from their portfolios. While bonds or dividend funds have traditionally been the go-to options, a broader mix of income-focused investments can be equally compelling.

Multi-asset income funds aim to meet this need by investing across asset classes that not only generate income—through interest and dividends—but also pursue capital growth. Because these funds focus primarily on income, their balance between riskier and more defensive assets is often more flexible than that of traditional allocation funds. This means the risk profile can differ from what investors might expect from classic multi-asset strategies. What’s more, income funds aren’t a uniform group: they vary widely in asset composition, payout levels, and distribution frequency.

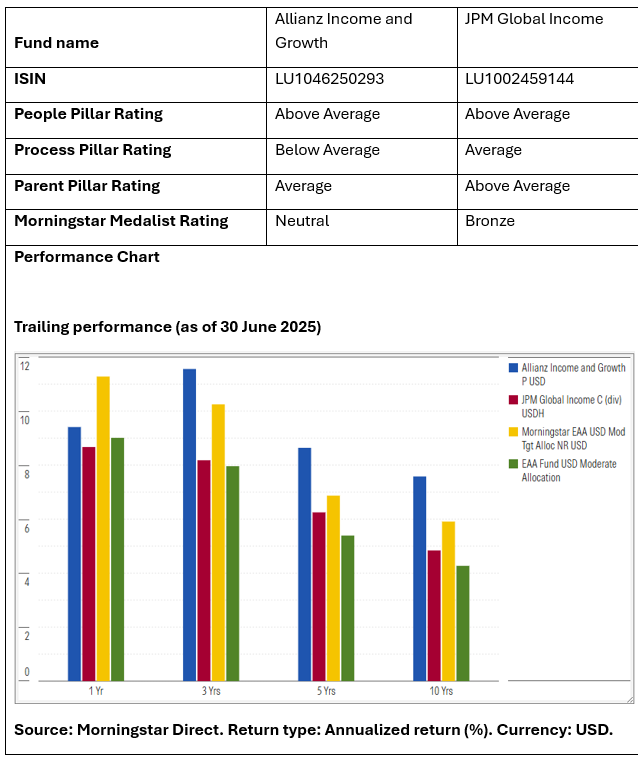

Against this backdrop, we’re comparing two funds in the Morningstar USD Moderate Allocation category that receive analyst ratings: Allianz Income and Growth and JP Morgan Global Income. With 54 billion dollars and 20 billion dollars in assets under management respectively, these are among the largest allocation funds in Europe.

People

The Income and Growth team has shown consistency and growth despite outside challenges, earning it an Above Average People rating. Justin Kass and Michael Yee have been with the strategy since it launched in 2007, and David Oberto played a key role well before being promoted to portfolio manager in 2017.

After former CIO Douglas Forsyth announced his retirement in 2021, Kass stepped into the CIO role and gradually handed off convertible bond responsibilities to Ethan Turner. The 2022 transition to Voya Investment Management, after U.S. regulators imposed a ban on Allianz Global Investors, was smooth. All investment tools and personnel were retained, and the team has continued to expand thoughtfully.

At JP Morgan, day-to-day portfolio duties fall to Michael Schoenhaut and Eric Bernbaum, who’ve been with the strategy since 2007 and 2014 respectively. Gary Herbert joined in early 2021, while Jeff Geller and Leon Goldfeld serve as the third and fourth managers. In April, JP Morgan announced Geller plans to step down from portfolio duties in Q1 2026 and retire later that year. While Geller’s departure is notable, Morningstar sees no impact on resources or team cohesion, supporting the fund’s Above Average People rating.

Process

Schoenhaut and Bernbaum work closely with other JP Morgan managers to construct the underlying asset and sector exposures, ensuring alignment with the strategy’s income objective. The fund is flexible and can allocate up to 100 percent to fixed income, though high-yield bonds are capped at 70 percent, and equities are limited to 60 percent. While experienced and thoughtful, the team’s income strategy hasn’t shown a clear edge over peers—earning it an Average Process rating.

Allianz, meanwhile, aims to pay out a regular dividend from a portfolio composed roughly one-third each of U.S. equities, high-yield bonds, and convertible bonds. But the high correlation and risk overlap among those asset classes expose the fund to sharp market swings. The fund’s unconventional design and fixed payout target add unnecessary volatility, resulting in a Below Average Process rating.

Portfolio

Unlike traditional conservative, balanced, or growth allocation funds, multi-asset income funds typically favor high-dividend, value-oriented stocks. That’s not the case with Allianz Income and Growth, where the equity sleeve leans more toward growth stocks in cyclical sectors. The bond side also takes on more credit risk than standard allocation funds, and the portfolio is heavily tilted toward U.S. assets, limiting geographic diversification.

JP Morgan, by contrast, has kept about 40 percent of its equity sleeve in value-oriented stocks over the past five years. On the bond side, U.S. high-yield debt has consistently accounted for around 75 percent of fixed income exposure (as of June 2025).

Performance

High-yield bonds often move in tandem with equities during times of market stress. The lower their credit quality, the greater the default risk in economic downturns.

Allianz’s risk-heavy approach and U.S. equity focus have produced strong long-term returns and yield. However, the strategy has also delivered sharp drawdowns, such as in March 2020 and again in 2022, when the fund dropped nearly 19 percent.

Multi-asset income funds face the challenge of providing steady income without undermining risk-adjusted total returns, particularly when dividend stocks lag growth names. While JP Morgan’s team has managed its components with care, the strategy hasn’t consistently outperformed the category benchmark.

Allianz GI vs JP Morgan AM in multi-asset income funds

Thomas De Fauw is a manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on both quantitative and qualitative research. The firm is part of the expert panel at Investment Officer.