Emerging markets outperformed developed markets in 2025 for the first time since 2017, driven largely by strong AI and tech gains in South Korea. This week Morningstar compares the Robeco Emerging Stars Equities fund with the Cullen Emerging Markets High Dividend Fund.

The Morningstar EM TME Index returned 16.04 percent in euro terms in 2025, comfortably outperforming the Morningstar Global TME Index, which gained 7.77 percent. The South Korean market was the standout performer; over the final three months of the year, the Morningstar Korea TME Index advanced nearly 27 percent, lifting its full-year return to approximately 75 percent.

Performance was driven primarily by beneficiaries of the AI investment boom, including Samsung Electronics (105 percent), SK Hynix (275 percent) and SK Square (318 percent), as well as rising global defense spending which supported gains in Hanwha Aerospace (163 percent). The strong performance of the South Korean equity market has been a key contributor to the overall strength of the emerging markets index. South Korea is the fourth-largest country in the index, with a weighting of approximately 13 percent, behind the heavyweight constituents China (28 percent), Taiwan (20 percent) and India (17 percent).

This week we focus on two funds in the Morningstar Category global emerging markets equity that are qualitatively rated by Morningstar analysts and have maintained an overweight allocation to South Korea: Cullen Emerging Markets High Dividend Fund and Robeco Emerging Stars Equities.

People

Cullen Emerging Markets High Dividend Fund and Robeco Emerging Stars Equities both earn Above Average People ratings, reflecting experienced leadership and generally stable teams, but they differ meaningfully in structure, resources and emphasis.

Cullen’s strategy is anchored by long-tenured lead manager Rahul Sharma, who has led the approach since its 2006 launch and benefits from continuity at a boutique firm known for exceptionally stable teams. This team is relatively compact and generalist in nature, with analysts contributing across a range of global and regional strategies. There is close collaboration among its 17 portfolio managers and analysts. Their stability, coupled with founder James Cullen’s long-standing presence, underscores a culture of continuity and incremental evolution.

Robeco Emerging Stars Equities, by contrast, is part of a larger and dedicated platform. Leadership is shared between seasoned emerging-markets veterans, notably Jaap van der Hart and long-time team head Wim-Hein Pals, and backed by a structured team of five portfolio managers, each responsible for one or more countries or regions and providing top-down input. The team benefits from Robeco’s broader capabilities, including a robust quant team with impressive resources that maintains the rankings/scoring systems used in portfolio construction. This partially offsets a less experienced analyst bench. While senior leadership has been stable, Robeco has experienced some analyst turnover, particularly in China.

Process

Cullen Emerging Markets High Dividend Fund and Robeco Emerging Stars Equities both employ disciplined, valuation-conscious processes, but they differ notably in objectives and structure. Cullen earns a Process Pillar rating of Above Average, while Robeco receives a High.

Cullen follows a defensive, income-oriented approach that emphasizes high dividend yield, low valuations, and downside protection. Its process begins with broad screening for attractively valued, dividend-paying emerging-market stocks, followed by detailed fundamental analysis focused on financial strength, management commitment to dividends, and resilience during market stress. Country stability is a key consideration, and while the strategy is cautious by design, it also seeks upside through identifiable catalysts.

Robeco Emerging Stars Equities is value-oriented, conviction-led and is more top-down driven. The strategy is managed within a clearly defined two-step framework combining top-down country allocation and bottom-up stock selection. Quantitative models play a central role in shaping both country and stock decisions, serving as idea generators and discipline enforcers alongside fundamental research. The strategy targets mispriced companies with competitive advantages. Its benchmark-unconstrained but tightly risk-controlled design results in a concentrated portfolio with modest turnover.

Portfolio

Cullen Emerging Markets High Dividend Fund and Robeco Emerging Stars Equities both run portfolios of roughly 50 stocks and take active country and stock-level positions. Cullen operates within explicit limits on country, sector, and position sizes, yet retains sufficient flexibility to remain benchmark-agnostic and construct a dividend-oriented portfolio with below-market valuation multiples.

While the strategy has historically maintained a structural underweight to South Korea, allocations increased from mid-2025 via new positions like Kiwoom Securities and HD Korea Shipbuilding & Offshore Engineering. Robeco manages a high–active-share, benchmark-unconstrained portfolio firmly anchored in the value style, expressing conviction through pronounced country and sector tilts. South Korea has been a long-standing structural overweight, representing roughly a quarter of assets, including top 10 holdings like: Samsung Electronics, SK Square, Hana Financial Group and Kia Corp.

Performance

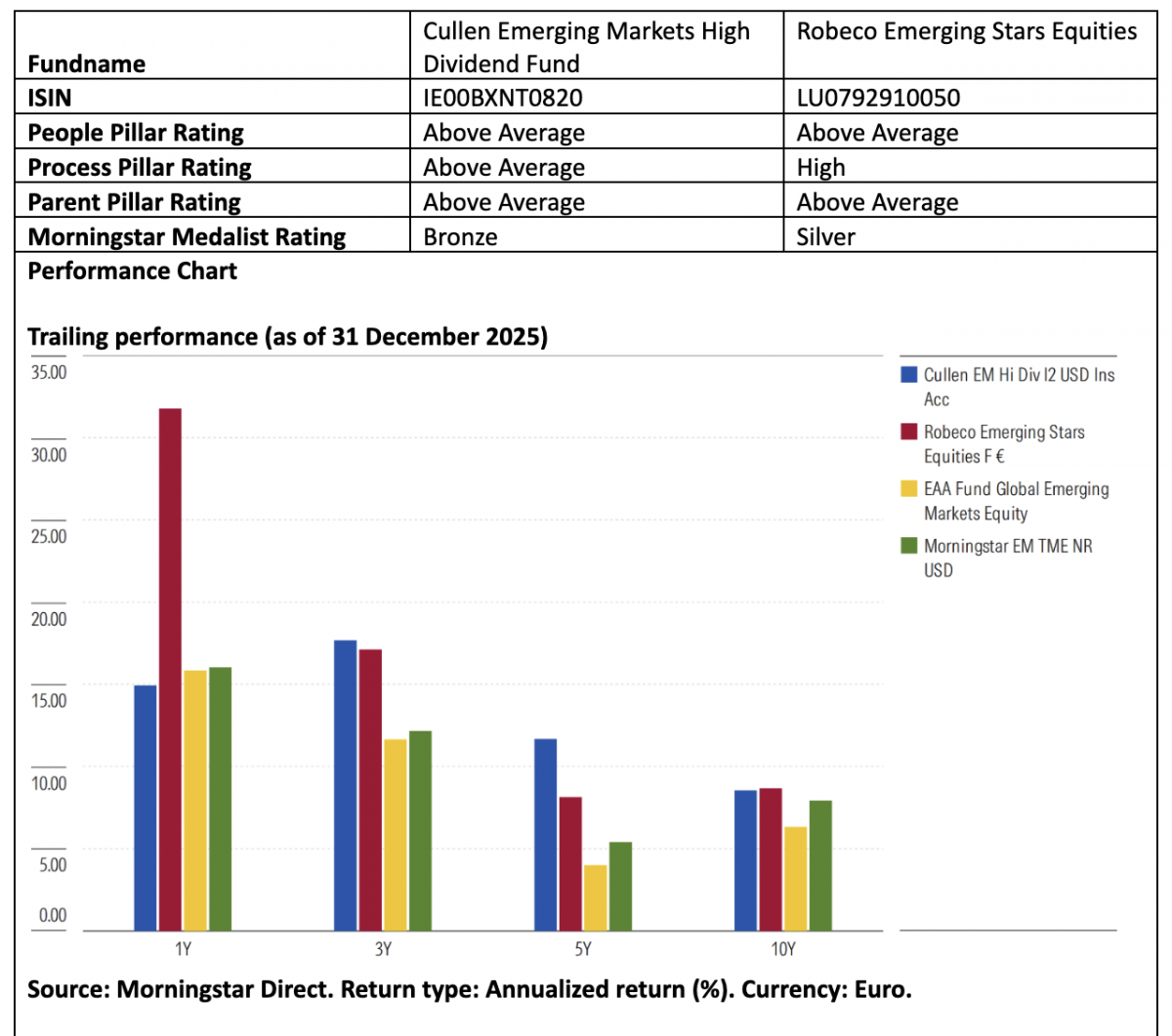

Cullen Emerging Markets High Dividend Fund and Robeco Emerging Stars Equities have both delivered long-term outperformance in emerging markets. Since the Cullen Emerging Markets High Dividend Fund was incepted in 2012, its edge has come primarily from losing less in market downturns, aided by defensive positioning. However, this conservative approach also led to relative underperformance during strong market rallies, including the one in 2025. The strategy was unable to capitalize on its overweighting in South Korea as it was only introduced mid-year, partly missing out on periods of the county’s strong performance.

Robeco Emerging Stars Equities has outperformed its benchmark and peers over the long run, but with significantly higher volatility. The fund experiences pronounced performance swings, lagging sharply during periods dominated by growth or adverse market conditions. Yet, it excelled when its style and country bets aligned with market trends, such as in 2009, 2021 to 2023, and especially in 2025, when it benefited strongly from its overweight position in South Korea and successful stock selection within the country.

Ronald van Genderen is a senior manager research analyst at Morningstar. Morningstar analyzes and rates investment funds based on quantitative and qualitative research. The firm is a member of Investment Officer’s expert panel.