Exceptional investment strategies are rare, as reflected in Morningstar’s qualitative fund ratings. Fewer than six percent of actively managed funds qualitatively assessed by Morningstar analysts in Europe achieve a High score on both the People and Process pillars, placing them in the highest conviction category.

These funds are characterized by experienced portfolio managers, strong research capacity, and a structured, repeatable investment process. They consistently apply a clear investment philosophy and have the expertise and resources to harness a sustainable competitive edge. While annual performance may vary, these qualities increase the likelihood of outperforming peers and benchmarks over the long term.

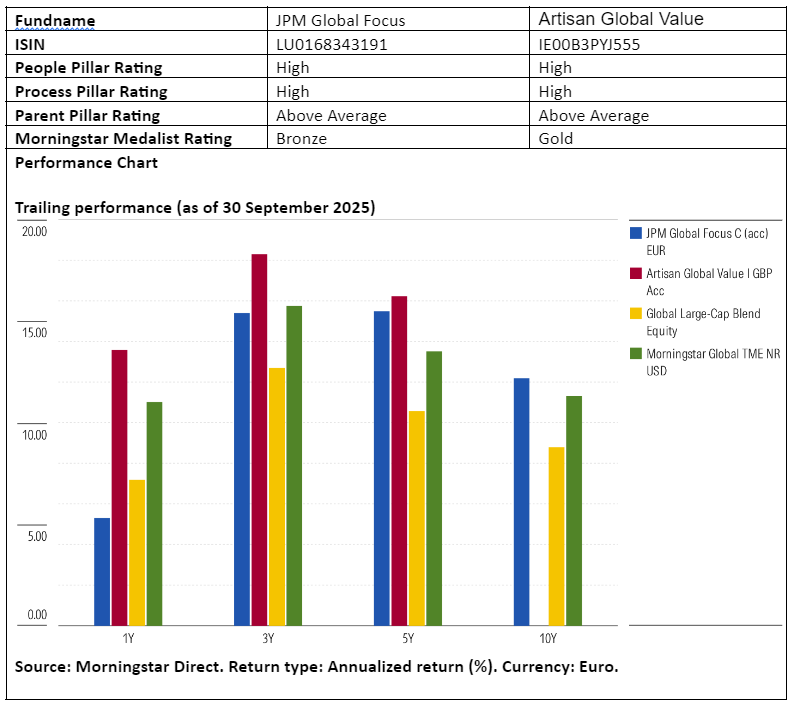

In its Best of Breed report, Morningstar highlights this exceptional group: only 49 funds that rank among the best in their class. Among them are two global equity strategies: JPM Global Focus, with a blended profile, and Artisan Global Value, which leans more toward value. Let’s explore their similarities and differences.

People

Helge Skibeli, with nearly 40 years at JP Morgan, has led the Global Focus strategy since 2019, supported by co-managers James Cook and Sam Witherow. The team emphasizes collaboration, transparency, and continuous improvement, with a manageable workload despite Skibeli’s additional responsibilities. Backed by JP Morgan’s analyst team of about 80 sector specialists with an average of 17 years’ experience, it benefits from a deep research foundation supporting stock selection.

At Artisan Global Value, Dan O’Keefe has managed the fund since 2007. He is deeply involved in equity research and invests substantially in the fund himself. O’Keefe and co-manager Michael McKinnon, in that role since 2018 with more than 20 years’ experience, are supported by a four-person analyst team combining generalist skills and regional expertise. The team distinguishes itself with a strong culture and a long-term vision.

Process

JPM Global Focus follows a structured, disciplined approach based on bottom-up stock selection and leveraging JP Morgan’s global research platform, which covers more than 2,500 companies. Analysts classify businesses as premium, quality, standard, or challenged, based on structural attractiveness, balance sheet strength, and cash flow sustainability. The managers primarily target premium and quality names but remain valuation-conscious, using five-year return targets as benchmarks to avoid overpaying.

Artisan Global Value also emphasizes balancing quality and valuation but sets itself apart through an independent, benchmark-agnostic approach. It focuses on high-quality, shareholder-friendly companies deemed undervalued relative to their intrinsic worth. The strategy combines quantitative screening with deep fundamental analysis, is selective about regions and sectors, and applies a long-term perspective. When opportunities are scarce, cash can rise to 15 percent, while currency exposures are tactically hedged.

Portfolio

The JP Morgan team builds a portfolio of 40–65 positions, with the top 10 accounting for 42.3 percent, reflecting the managers’ high conviction. Stock selection is the primary driver of returns, while active deviations at country or sector level remain limited. Turnover ranges between 50 percent and 100 percent, depending on valuation changes. The fund focuses on large, financially strong companies with durable competitive advantages, with modest overweights in technology, cyclical consumer goods, and emerging markets, and an underweight in defensive consumer goods.

Artisan Global Value holds 40–60 positions, mostly at the intersection of value and blend in the Morningstar Style Box, underscoring the team’s focus on quality and valuation. The portfolio underweights US equities and avoids most of the Magnificent Seven, but includes US financials such as Berkshire Hathaway and Charles Schwab. Samsung Electronics remains a key position despite recent setbacks, reflecting the team’s conviction and long-term view of its recovery potential.

Performance

Under Skibeli’s leadership, JPM Global Focus has delivered solid returns in recent years, outperforming both its category and the MSCI World Index. While volatility was slightly higher, this translated into strong risk-adjusted results. Outperformance has largely stemmed from careful stock selection, with a focus on high-quality, resilient companies that hold up well even in stressed markets.

Artisan Global Value has an excellent long-term track record, though recent years have been more challenging. Its valuation-driven focus proved limiting, with the underweight in US equities and stock selection holding back results, partly due to missing out on some strongly performing US stocks. Over the long run, however, results remain solid versus both the broader market and the value index.

Jeffrey Schumacher is director of manager research at Morningstar Benelux. Morningstar analyzes and rates investment funds based on quantitative and qualitative research. Morningstar is a member of the expert panel of Investment Officer.