Trend-following strategies, also known as managed futures, have historically performed well during periods of strong market movements. They benefit from price fluctuations in both rising and falling markets. However, trendless or sideways markets tend to pose a greater challenge.

This became painfully clear in the early months of 2025. As of April 30, the rolling 12-month return for trend-following strategies stood at -18.6 percent. For comparison, the Société Générale (SG) Trend Index has only twice before posted a 12-month loss greater than 15 percent.

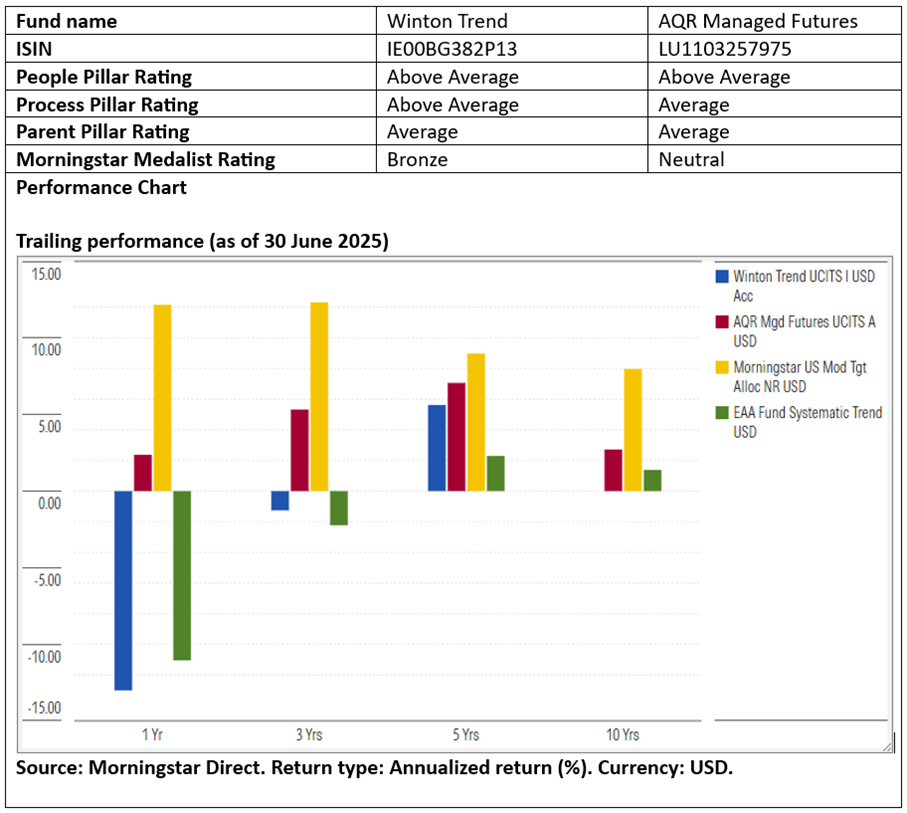

Against this backdrop, we take a closer look at two funds in the Morningstar Systematic Trend EUR category. Morningstar analysts provide a qualitative comparison of Winton Trend Ucits and AQR Managed Futures Ucits, highlighting their similarities and differences.

People

Winton has emerged stronger from this difficult period and is now in solid shape. The firm has adopted a leaner and more focused structure while maintaining its proven systematic investment capabilities and robust operational infrastructure. Since 2020, the strategy has been led by co-chief investment officers Simon Judes and Carsten Schmitz, working closely with the executive management team, which includes founder David Harding. Thanks to this experienced and stable leadership, the strategy earns an Above Average People rating.

At AQR, the mid-2024 departure of Yao Hua Ooi marked a setback, given his key contributions to the development of the managed futures strategy. Nonetheless, the firm’s team-based approach and the formal integration of its research group helped absorb the blow. The macro strategy group is now co-led by John Huss and Jordan Brooks. Portfolio managers also draw on AQR’s strengths in portfolio implementation, engineering, and independent risk management. These resources provide essential support in effectively shaping desired exposures, supporting an Above Average People rating.

Process

Trend-following strategies typically spread their exposure across commodities, currencies, bonds, and equities, without necessarily relying on deep domain expertise. These purely quantitative approaches make decisions based on price movements and data patterns.

AQR, however, began integrating fundamental data alongside price-trend data in late 2018. By 2022, its signal mix was roughly split between traditional price-based trends and a broader set of economic indicators such as inflation and growth expectations. This shift marked a transition from a classic trend-following strategy to a broader quantitative multi-strategy approach with more diversification. The strategy receives an Average Process rating.

Winton Trend UCITS, by contrast, remains a pure trend-following strategy. However, it lacks some of the innovations now emerging across the sector that aim to diversify and optimize return profiles, such as exposure to less liquid alternative markets or signals designed to perform in sideways markets. That said, Winton’s refined risk management and sophisticated portfolio construction remain core strengths, warranting an Above Average Process rating.

Portfolio

Both Winton and AQR primarily invest in global, liquid futures markets and maintain solid risk diversification across asset classes. Winton’s investable universe now includes over 150 markets, contributing to a high-capacity portfolio. AQR’s flagship strategy also trades hundreds of contracts, though its Ucits version faces stricter constraints, particularly in commodities. In 2022, AQR began adding alternative markets to its portfolio, including interest rate derivatives from emerging markets and EU carbon emission allowances. These are niche markets that offer sufficient liquidity and data for model-driven trading. Winton does not allocate to alternative markets in this product.

Volatility targets are broadly similar: Winton aims for an annualized long-term volatility of 10 to 12 percent, while AQR targets 10 percent. Both managers use multiple time horizons to capture trends, ranging from about one month (just days, in Winton’s case) to roughly a year. On average, AQR uses a 3–4 month blend of signals, while Winton uses a 3–6 month range, with stock index exposure leaning toward shorter-term signals.

Performance

The return dispersion across trend-following strategies can seem surprising at first, given their similar objectives and systematic design. But as the design differences discussed above show, such strategies can be positioned quite differently, leading to divergent performance outcomes. For example, AQR Managed Futures performed much better than Winton Trend in the first half of 2025, thanks in part to its use of non-price-based signals.

Winton’s more erratic return pattern underscores the limitations of a pure trend-following approach. While the strategy has largely delivered on its promise to diversify away from traditional asset classes, it remains vulnerable in sideways markets and during sharp price reversals. Its relative underperformance since launch also reflects the stronger returns seen in alternative markets or non-trend signals, from which AQR has benefited in recent years.

Winton and AQR in Managed Futures

Thomas De Fauw is a manager research analyst at Morningstar. Morningstar evaluates and rates investment funds based on both quantitative and qualitative research. The firm is a member of the Investment Officer Expert Panel.