Two weeks ago, we wrote that gold was poised to skyrocket. Last week, it took its biggest hit in a decade. Markets have a way of humbling both investors and journalists, and few assets do it as reliably as the yellow metal.

“Gold could still double,” Investment Officer headlined in four languages. The metal, it seemed, was destined to shine even brighter after this year’s rally. After all, it had already surged more than 50 percent in dollar terms. Now that the price direction has changed, so has the commentary.

Gold futures (USD)

Valuing gold is inherently difficult, as it produces no profits or cash flows to base an estimate on. However, there are ways to gauge whether gold is getting ahead of itself, and some of those signals are now flashing red.

Consulting firm Capital Economics expects the next major move in gold over the coming year to be more likely down than up. Group economist Neal Shearing put it bluntly: “Spotting bubbles is never an exact science, though when it looks and acts like one, it probably is.”

A new logic for gold

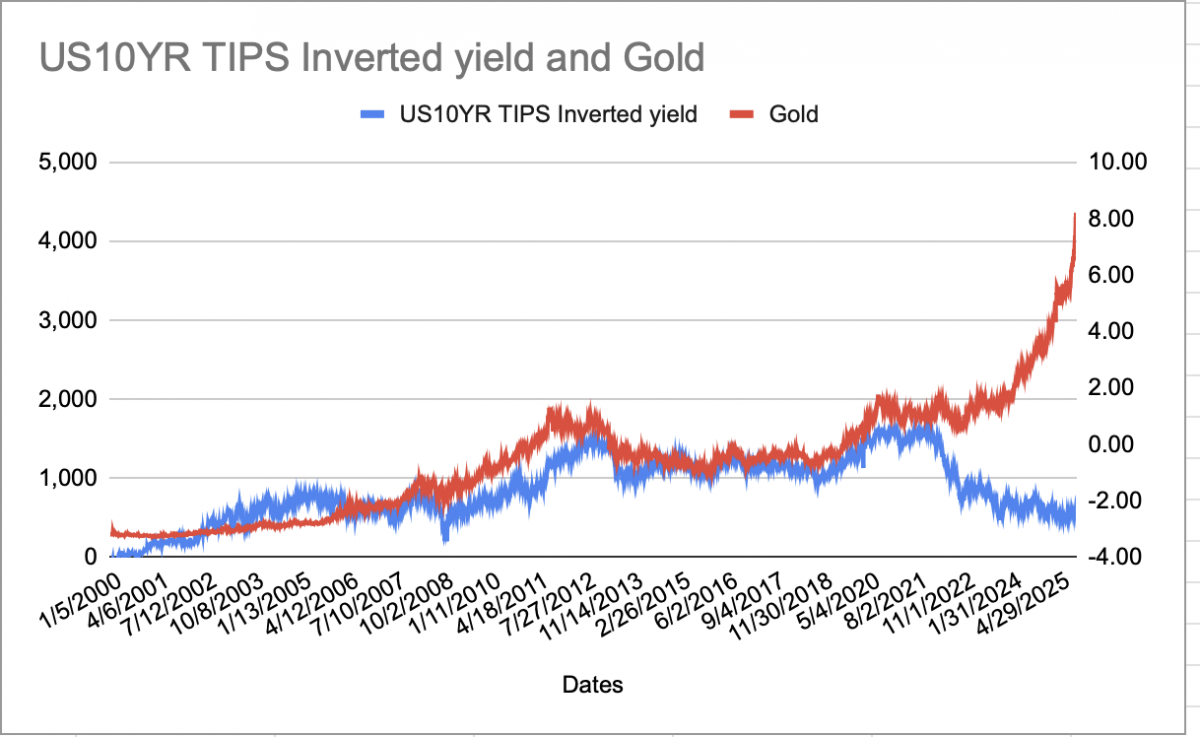

Shearing points out that, until recently, gold’s moves could be explained by straightforward macroeconomics. The metal usually trades in the opposite direction of real yields, the returns investors earn on US government bonds after accounting for inflation.

The logic was simple: gold doesn’t pay interest, so when real yields rise, investors can earn more elsewhere, making gold less attractive. When real yields fall, that opportunity cost disappears and gold tends to climb.

That rule of thumb worked for most of the past 20 years. But in 2022, the link between gold and real yields broke down. Since then, prices have kept rising even as real yields moved higher, suggesting that something other than cold financial logic has been driving the market.

Asset managers tend to offer one of two explanations to justify gold’s surge this year. One blames central banks; the other blames politics. Shearing isn’t convinced by either.

The first story is that official buyers, led by the People’s Bank of China, have been quietly shifting out of dollars and into bullion. It’s true that China’s holdings of U.S. Treasuries have dropped from over 1 trillion dollars in 2020 to about 700 billion dollars today.

The West’s freezing of Russia’s reserves in 2022 was a wake-up call for countries wanting a “sanction-proof” store of value. But this trend has been around for years. It doesn’t explain why gold suddenly took off again this past summer.

The second theory is the so-called “debasement trade”: the idea that political turmoil in Washington is driving investors into hard assets to escape currency erosion.

“But the data doesn’t back that up,” said Shearing. “The dollar has been steady for months, Treasury yields have been falling, and inflation expectations are hardly running wild. If this is a panic about fiat money, it’s a very quiet one,” he said.

The more likely explanation is simpler: gold went up because gold was going up. Shearing thinks it started innocently enough, with real, fundamental demand from central banks. But what began as a justified rise “took on a momentum of its own,” he wrote. Gold prices, he noted, have moved almost in sync with Google searches for “gold ETF,” a neat proxy for retail excitement. In other words, what started as a hedge against inflation turned into a case study in FOMO.

That view is echoed by Cassidy Ainsworth-Grace, global macro strategist at Oxford Economics. “The recent rally in gold didn’t appear to be driven by fundamentals or fears of currency debasement,” she said, “but by momentum and positioning.”

Speculative shine

That momentum is now showing up in the numbers. Futures data show a build-up in speculative long positions, while ETF inflows hit record highs in the third quarter. Add to that a new wave of trading apps, easy access to gold ETFs and the occasional viral post on social media, and you get a market that looks a lot like WallStreetBets, the Reddit forum that helped send GameStop and other “meme stocks” into orbit back in 2021.

PIMCO co-founder Bill Gross had the same thought this week in an interview with Business Insider. “Gold has achieved ‘meme-stock’ status,” he said.

There have been two previous bursts of gold exuberance since the end of the Bretton Woods system that tied the metal to the dollar, in the late 1970s and again in the early 2010s. Both ended the same way: with steep declines. In the early 1980s, gold lost about 60 percent of its value in real terms; in the mid-2010s, around 40 percent.

Could this time be different? Perhaps. But as ING strategist Simon Wiersma told gold buyers on Monday: “Good luck! And don’t start grumbling if the price doesn’t move in the direction you were hoping for.”