U.S. large-cap stocks are extending their rally into the new year, but a growing number of asset managers are entering 2026 with a more cautious view on expensive artificial intelligence bets. Many start to see better opportunities in value stocks.

Over the past month, the best-performing sectors in the S&P 500 were materials, industrials and financials. “I call it AI-fatigue,” said Ed Yardeni, president and chief investment strategist at Yardeni Research. He told Bloomberg News on Wednesday that doubts about AI’s ability to deliver sweeping economic change are starting to weigh on his appetite for AI stocks. Other institutional managers, he said, are feeling the same.

Taiwan concerns

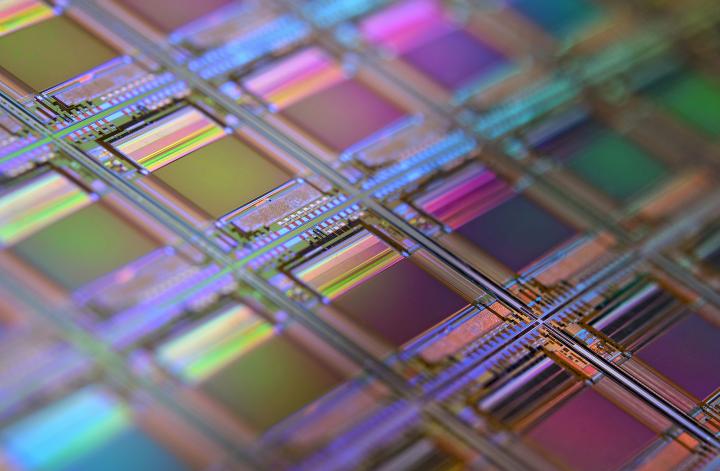

Yardeni also warned that geopolitics could quickly eclipse valuation concerns if tensions between Washington and Beijing escalate, with Taiwan, a critical hub for AI and tech stocks, representing the most acute flashpoint. “Of all the ways President Donald Trump’s bromance with China’s President Xi Jinping could go awry, Beijing’s moving against Taiwan could be the quickest,” he wrote, pointing to growing speculation in Chinese online discourse following the Trump administration’s capture of Venezuelan president Nicolas Maduro, which some framed as a possible template for action.

Yardeni also warned that geopolitics could quickly eclipse valuation concerns if tensions between Washington and Beijing escalate, with Taiwan, a critical hub for AI and tech stocks, representing the most acute flashpoint. “Of all the ways President Donald Trump’s bromance with China’s President Xi Jinping could go awry, Beijing’s moving against Taiwan could be the quickest,” he wrote, pointing to growing speculation in Chinese online discourse following the Trump administration’s capture of Venezuelan president Nicolas Maduro, which some framed as a possible template for action.

“Of all the ways President Donald Trump’s bromance with China’s President Xi Jinping could go awry, Beijing’s moving against Taiwan could be the quickest.”

Ed Yardeni, Yardeni Research

Against that backdrop, Yardeni said the risk that Xi could act sooner rather than later is rising. “The idea that Xi will choose 2026 to check off this most vital of Communist Party boxes is no longer as far-fetched as Asian leaders and investors had hoped,” he noted, a scenario that would carry profound implications for markets heavily exposed to global trade and technology supply chains.

Pricy expectations

Vanguard, meanwhile, is among a growing group of managers taking a more careful view on AI. The issue, the firm said, is not AI-technology itself, but the expectations priced into shares. According to Qian Wang, Vanguard’s global head of capital market research, AI-related valuations may have “moved ahead of fundamentals despite strong earnings”.

Vanguard, meanwhile, is among a growing group of managers taking a more careful view on AI. The issue, the firm said, is not AI-technology itself, but the expectations priced into shares. According to Qian Wang, Vanguard’s global head of capital market research, AI-related valuations may have “moved ahead of fundamentals despite strong earnings”.

At Pimco, the focus is on how the AI boom is changing the economics of the technology sector. Marc Seidner, the firm’s chief investment officer for non-traditional strategies, said tech has shifted from being “capital-light” to “capital-intensive”. AI companies, once largely funded by free cash flow, are increasingly financed through debt, he noted.

Circular deals

Seidner also noticed another spending trend: “The biggest hyperscalers and chipmakers are funneling billions of their investment dollars into one another through circular deals that amplify sector-specific risks.”

There are signs that investors are already applying more discipline within the technology sector itself. As noted recently by Financial Times columnist Robert Armstrong, investors have begun to differentiate between AI spending that can be funded from internal cash flows and projects that rely more heavily on debt, as well as between credible business models and more speculative bets.

“When expectations get too far out of whack, it is not surprising to see markets pull back.”

Qian Wang, Vanguard

It’s one explanation why companies like Oracle and Meta have lagged in recent months, while shares of key AI hardware suppliers, like Nvidia and Broadcom, have largely traded sideways, suggesting enthusiasm is becoming more selective rather than indiscriminate.

Vanguard also points to extreme concentration as a growing risk. The seven largest tech stocks known as the Magnificent 7 (Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta Platforms, and Tesla) account for roughly 34 percent of the total market capitalization of the S&P 500 index.

US market vulnerable

Current levels of concentration are high for the USA, but still lower than France, German and UK markets. Still it leaves the American market highly sensitive to any sign that expectations are peaking, according to Wang. “When expectations get too far out of whack, it is not surprising to see markets pull back,” Wang said.

Against that backdrop, Vanguard favors non-U.S. equities for their higher expected returns and diversification benefits. “Within the U.S., we see muted prospects for growth stocks but have a more constructive view on value,” Wang said.

Pimco too believes value-oriented stocks remain attractively priced relative to historical averages, suggesting potential for mean reversion over time. Seidner expects U.S. economic growth to remain close to trend, a backdrop that could allow earnings to broaden beyond a narrow group of technology leaders.

“In such an environment, value stocks tend to benefit, particularly if the Federal Reserve continues easing into steady growth rather than responding to a downturn,” Seidner said. Markets widely expect the Fed to cut once or twice in 2026.

Early 2025 calls premature

A year ago, Investment Officer reported similar calls from asset managers who argued that opportunities were emerging outside the largest U.S. growth stocks. Those calls proved premature, as U.S. growth and mega-cap technology again ranked among the best-performing segments of the market in 2025.

But in Europe, value stocks have outperformed growth since 2024, helped by stronger returns in financials, industrials and utilities. At Janus Henderson, portfolio managers Ben Lofthouse and Callum Rushforth said those sectors carry more weight outside the U.S. and are less exposed to the crowded technology trade. Many high-quality growth companies, by contrast, rely heavily on U.S. sales. That left them more vulnerable to tariffs and a weaker dollar, weighing on returns last year.

Invesco expects a more balanced relationship between growth and value as economic momentum shifts. Paul Jackson, the firm’s global market strategist, said the pattern was already visible in 2025, when Invesco’s value factor indexes outperformed growth in both the U.S. and Europe despite the intense focus on AI. In the U.S., value was the strongest-performing factor. In Europe, it was second only to price momentum.

Strength in banks, basic resources

Jackson links that performance to strength in sectors such as banks and basic resources, which tend to benefit as growth broadens and interest rates remain elevated. Looking ahead, Invesco expects global growth to accelerate in 2026, supported by rising real incomes, monetary easing in some regions and fiscal expansion in others. In that environment, Jackson said, value stocks could continue to benefit, particularly if long-term bond yields rise, a development that would likely weigh on growth stocks with longer-dated cash flows.

The Buffett Indicator, which compares the total value of U.S. stocks with the size of the economy, is now above 200 percent of GDP.

One final reference point may appeal to value investors. The so-called Buffett Indicator, which compares the total value of U.S. stocks with the size of the economy, is now above 200 percent of GDP. Warren Buffett once described it as “the best single measure of where valuations stand.” The ratio peaked at roughly 140 to 150 percent during the dotcom bubble and was closer to 100 percent ahead of the global financial crisis. It is not a timing tool, but at levels like these, even Buffett might agree that paying less for earnings starts to look like common sense again.