Allianz CIO: ‘Monetary policy is really starting to bite’

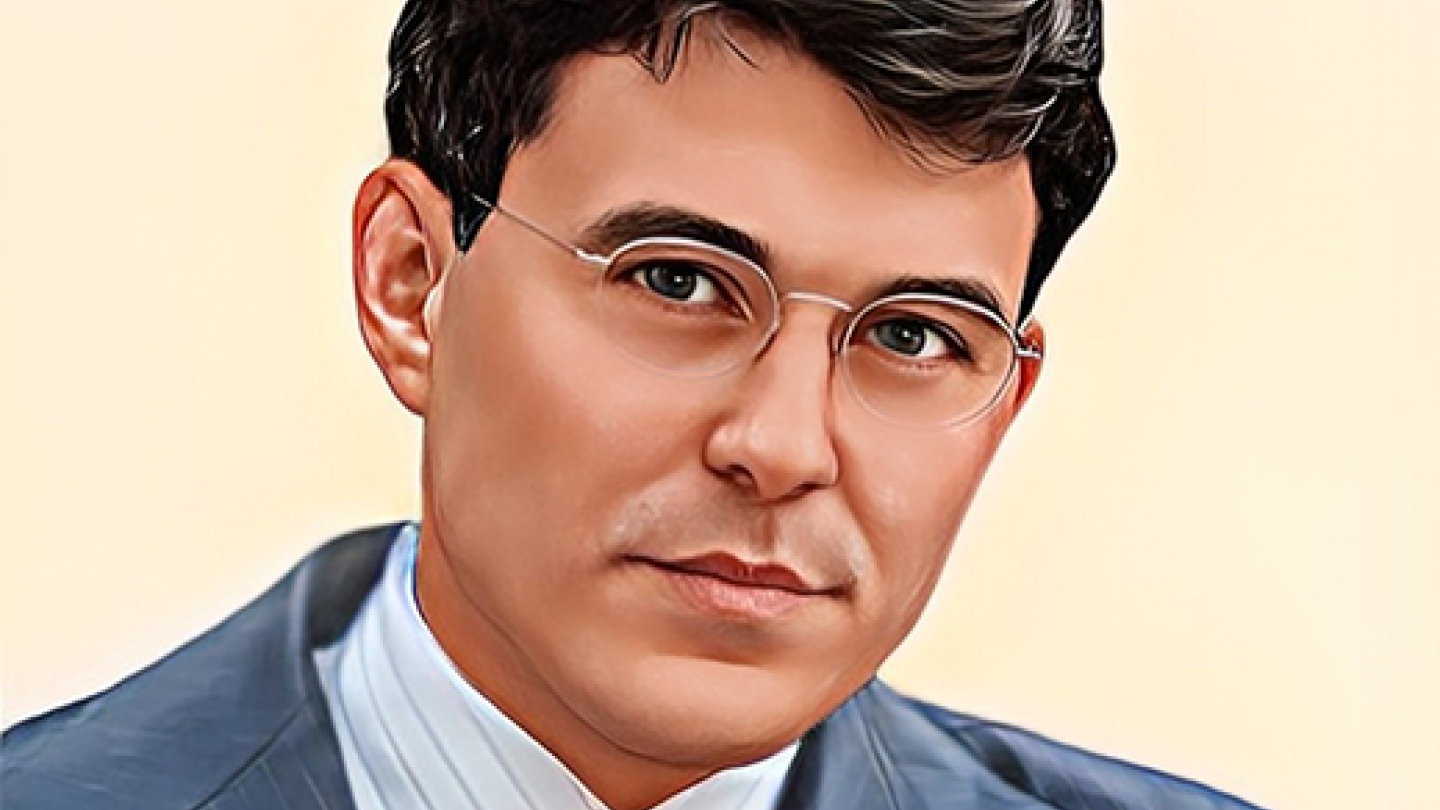

The Federal Reserve’s predicted interest rate peak between 5.5% and 5.75% has left many asset managers uncertain about their rate forecasts for the second half of the year. However, Franck Dixmier, the global CIO at Allianz Global Investors, is undeterred by this ambiguity, stating, “Monetary policy is really starting to bite now.”

Debunking the myth of active management

“Active management is a sham — no wonder my returns are suspect,” writes Stuart Kirk, FT columnist and former portfolio manager, in his latest attack on active management. However, he conveniently overlooks one important detail.

Credit crunch risks overshadow US earnings

In the U.S., a surge in deposits from small to medium-sized lenders is leading to a credit crunch across the country as smaller financial institutions sell mortgages and bonds at record pace to offset losses. This looming crisis is causing concern within financial markets about how it will affect economic growth moving forward.

‘Gold deserves a structural role in the portfolio’

Panic over banks and falling treasury yields have gold prices flirting with an all-time high again. In the short term, a quicker turn by the Federal Reserve may be the deciding factor, but the precious metal’s real success lies deeper. “Gold deserves a structural role in the portfolio.”

Gold prices briefly climbed past the 2,006 dollar per troy ounce level last week. With that, the August 2020 all-time high of 2,075 per troy ounce is getting closer.

Viral bank runs increase liquidity risks

Apps and online investment services have led to a new type of consumer behaviour. Bank runs go viral, introducing a new type of liquidity risk for banks and investment services. The ECB warns the threat may not be ignored.

Investors scratch their heads over cursed 60/40 portfolio

After a formidable start for the capital markets in 2023, followed by the “SVB correction”, a consensus on the sense and nonsense of the 60/40 formula still remains to be found. Investment Officer takes stock again.

Biggest US bank bust since 2008 exposes interest risks

Has the sudden collapse of Silicon Valley Bank ignited fears of a new financial crisis? Or is its demise incidental, offering investors an excuse to take profits on attractive gains that bank sector stocks booked in recent months?

As European financial markets closed on Friday, worried investment professionals were hard to find. The sentiment and rising interest rates however are clearly recognised as risk factors.

Jan van Eck: ESG investments require political intervention

The crusade against “woke capitalism” is entering a new phase in the United States now that Republican politicians turn against ESG policies in asset management. Jan van Eck, chief executive of the global ETF boutique carrying his name, this interference is fully justified, regardless of where one stands on ESG and sustainability investments.

Short the villain! ESG short-selling is unexplored territory

For those looking to make an impact investment without the pain of market corrections, the solution can be simple: Buy the best-in-class, short the villains, and keep the portfolio neutral.

Earlier this month, the European Securities and Markets Authority, Esma, warned of further corrections in the stock market. Esma chair Verena Ross said the resilience of the financial system was being tested by “fragile liquidity”. The warning proved justified.

Wall Street ‘Einstein’ Tuchman: new investors ‘crazy gangsters’

He is the New York Stock Exchange’s most photographed trader, also known as the “Einstein of Wall Street” on Instagram. Speaking to Investment Officer, veteran floor trader Peter Tuchman talks about the game changer in his profession: the new generation of investors.