In a world where climate risk is becoming an increasingly prominent factor, I argue that the psychological perception of this risk has a significant and measurable impact on asset prices.

In my new paper Climate Extrapolation and Relative Asset Pricing, I introduce and quantify a behavioral bias that I call “climate extrapolation.” I show that investors project their local climate information onto the valuation of a globally traded good, even when that good has no direct connection to their local environment.

Wine as evidence

To isolate this phenomenon, I use a unique “laboratory”: the global auction market for Premier Cru Bordeaux wines. By analyzing a new dataset of more than 68,000 transactions in 17 countries, I compare the prices of identical bottles of wine sold in France and abroad in the same month.

Wine is the perfect instrument for this: it is a homogeneous, non-cash-flow-producing real asset. This allows me to attribute price fluctuations directly to changes in the discount rate (the perception of risk) rather than to changing cash flow expectations, which often complicates equity analysis.

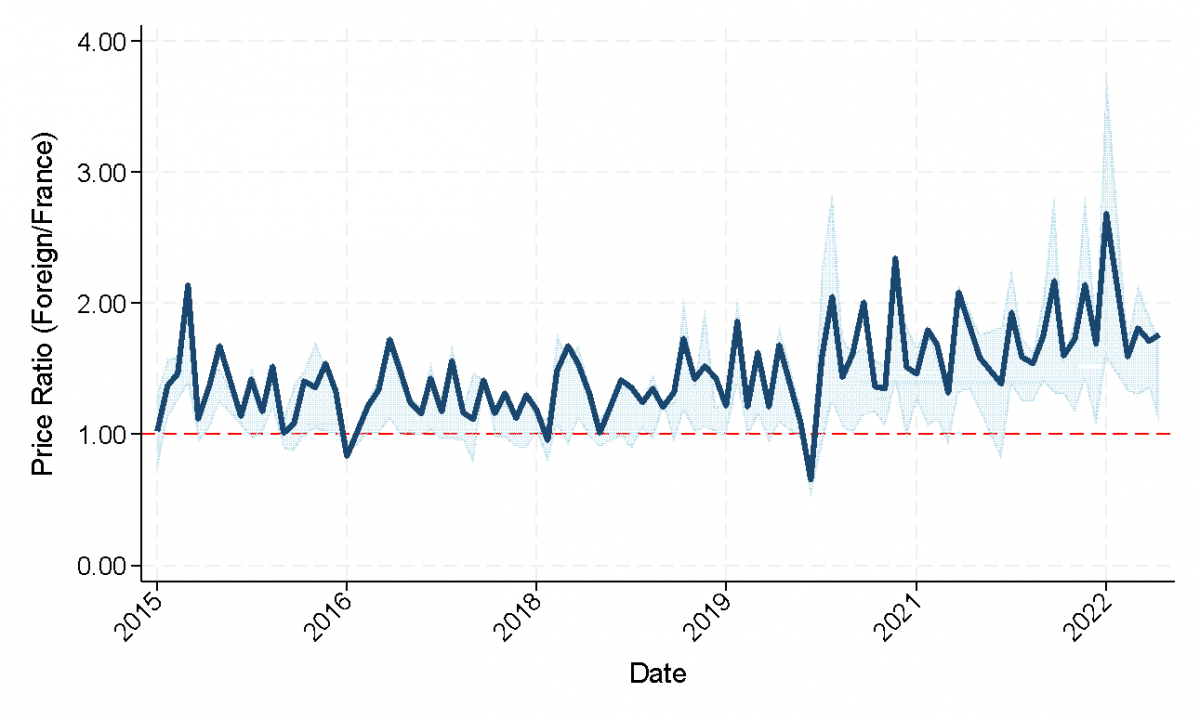

Figure: price ratio — identical bottles traded abroad and in France in the same month

The central conclusion of my study is striking: I show that an increase in relative climate attention in the news of a given country leads to a relative price decline of 3.58 percent for exactly the same bottle of wine in that same month.

My analysis further shows that this effect is amplified during the summer months, underlining its psychological basis. When the effects of climate change (such as heat waves) are physically felt, the availability heuristic weighs more heavily and investors adjust their perception of risk, resulting in lower bids.

Why this matters for investors

In my paper, I disentangle two channels that drive this price decline, both relevant to a broader set of assets:

- The consumer aversion channel: For goods with consumption value (such as wine nearing its optimal drinking window), increased climate salience reduces willingness to pay.

- The investor risk premium channel: This is the most crucial lesson for institutional investors. My research shows that the price effect is also significant for wines held purely as investment objects (collectables). Investors demand a higher risk premium for assets they perceive as sensitive to climate change. This effect is stronger for assets with more fragile brand value (in my study: lower-rated wines). That this occurs in an investment good entirely disconnected from the buyer’s local climate proves it is a purely behavioral—and therefore irrational—pricing factor.

Local perception

While my research focuses on wine, the implications are universal. My work exposes a fundamental market inefficiency driven by the geography of the investor.

- Geographic mispricing: My findings suggest that the price of a global asset (such as the stock of a multinational) can systematically deviate from its fundamental value, purely depending on the local sentiment of the investor base in a given region.

- Market fragmentation: As extreme weather events become more frequent and localized, this phenomenon could lead to greater sentiment-driven fragmentation of global capital markets.

- Opportunities for investors: For investors aware of this behavioral bias, arbitrage opportunities may arise. Assets systematically undervalued in one region due to temporarily heightened climate salience may be traded elsewhere at a more fundamental price.

Conclusion

My paper identifies and quantifies climate extrapolation as a new, relevant behavioral bias in financial markets. I provide evidence that investor psychology, shaped by direct local experiences, is a tangible pricing factor.

I hope my work encourages institutional investors to look beyond traditional, fundamental risk models. It is a call to account for sentiment-driven, geographically concentrated mispricings in a world increasingly shaped by the perception of climate change.

Gertjan Verdickt is assistant professor of finance at the University of Auckland and a columnist at Investment Officer. The academic paper can be found here.