Rising budget deficits have caused government bonds to lose much of their appeal as a safe haven for investors. High-quality corporate bonds have subsequently moved up the ranks. Has the rally run its course? Samuel Gruen, fixed income specialist at Rothschild & Co Asset Management, examined the European market from a historical perspective.

These are interesting times in bond markets, as some long-standing principles are being called into question. Higher returns no longer necessarily go hand in hand with higher risk, and traditional safe havens are no longer always viewed as such. “The key is to distinguish temporary anomalies from structural breaks in trends,” said Gruen.

Have corporate bonds become relatively expensive in the market?

Samuel Gruen: “From a historical perspective, corporate bonds are priced expensively compared with one or two years ago. Or put differently: if one says that corporate spreads, the yield difference relative to the risk-free rate, are currently relatively tight, that is simply a historically accurate observation. Of all corporate paper, European investment grade bonds are the least expensive, according to the data.”

“But there is another way to look at this issue. The spread for investment grade is significantly higher than what you would expect based on default risk. Specifically, for a five-year corporate bond with an A credit rating, current spreads imply a default risk of about 3.65 percent, whereas the historical default risk is only 0.15 percent, as statistics show. The market is therefore significantly overestimating the risk.”

“Our conclusion: high-quality corporate paper remains attractive, with the A rating segment offering the most appealing balance between return and risk.”

Can corporate bonds become the new safe haven? The US Treasury market is still much deeper.

“It is true that the size of the corporate bond market is nowhere near large enough to accommodate investors and provide the liquidity required to speak of a true safe haven. There is no debate about that. But what we do see is that the group of investors who, either due to regulation or their mandates, can choose between government bonds and corporate bonds clearly prefers corporate bonds.”

“The concept of a safe haven has several definitions. You can define it as an investment backed by a state guarantee, or as an asset class with low volatility. Those are two different things.”

What does volatility tell us?

“Between 2010 and 2020, we saw that expected volatility for five-year German government bonds and a comparable investment grade corporate bond was very similar and evolved in parallel. The only exceptions were genuine crisis or stress moments, when corporate bond volatility temporarily spiked.”

“From 2021 onward, however, we observe a significant divergence. Expected volatility for government bonds is 2 to 2.5 times higher than for corporate bonds. The market is therefore already pricing in that government bonds are more volatile than corporate bonds. Everyone in the market also senses that one type of bond behaves with more volatility than the other.”

What should we conclude from that?

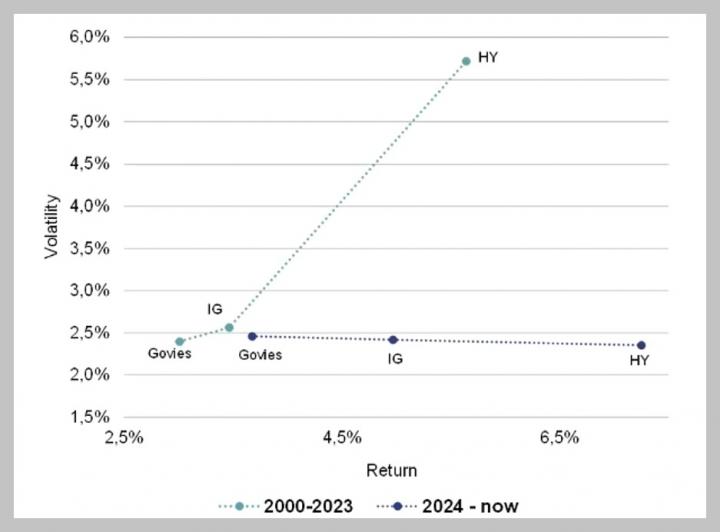

“One of the most important charts in finance today is the one plotting volatility and return for each asset class. What we were always taught at university is that if you want higher returns, you must accept higher volatility. Graphically, that is an upward-sloping line.”

“That relationship also held nicely in the period 2000–2023: government bonds had the lowest return and the lowest volatility, investment grade slightly higher return and slightly higher volatility, and high yield high return with high volatility. But what have we seen since 2024? The relationship no longer holds. The chart is even inverted. Government bonds have the lowest return but the highest volatility. High yield combines the highest return with the lowest volatility, and investment grade sits in between.”

“The crux is whether this is a lasting situation or a temporary aberration. According to some market participants, this is linked to the exceptional period in the global economy, but the sample size is still too small to draw firm conclusions. That is a fair point of view—perhaps not mine—but it is defensible. The alternative explanation or hypothesis is that markets are signaling that public finances are in worse shape than corporate balance sheets. They are of course difficult to compare, but I believe there is intuitive validity to this: corporate fundamentals are stronger than those of governments.”

“Prior to the financial crisis of 2008–2009, we saw that private sector leverage was high, which was one of the causes of that crisis. Afterward, we saw deleveraging in the private sector but releveraging in the public sector, with rising budget deficits.”

Chart: volatility and return for government bonds (Govies), investment grade (IG), and high yield (HY)

What will that relationship look like over the next five years?

“I think it will be U-shaped, with returns on government bonds and high yield remaining comparable to current levels, but with higher volatility in both cases. Investment grade bonds, which appear to have the strongest fundamentals, will form the bottom of the U: solid returns with low volatility.”

If the juxtaposition between government and corporate bonds changes structurally, does that not amount to a financial revolution?

“Revolution is too strong a word, and not one I would use. Again, not every market participant has a mandate to invest in corporate bonds. But it is a paradigm shift, yes.”

What could undermine the fundamentals of high-quality corporate bonds?

“There are two major risks: an investment boom or an M&A boom financed through debt issuance. In both cases, companies would increase leverage and weaken their fundamentals. But what do we see in Europe? For now, there are no major M&A waves, apart from some in the banking sector, and the capex boom is being financed by governments—think of the German stimulus program—or by technology companies with very high credit quality. So neither risk is currently materializing, but it is something to monitor in the coming years.”

Will the status of US Treasuries as a safe haven, which came under pressure in 2025, continue to erode?

“I find that quite difficult to say, because US Treasuries are still in a sense the benchmark. I return to what I said earlier: there is a group of investors who must use this asset class for liquidity reasons, simply because it is the largest category.”

“What we say about the government bond market, both in the United States and in Europe, is that it is fairly priced around the middle segment of the yield curve, but still looks expensive at the long end. The segment with maturities of ten years and longer appears expensive relative to shorter maturities.”