Are bonds issued by well-known champion companies as safe as government debt? More and more investors seem to think so, judging by the small yield differentials between, for example, Microsoft and US government paper or between AXA and French government bonds.

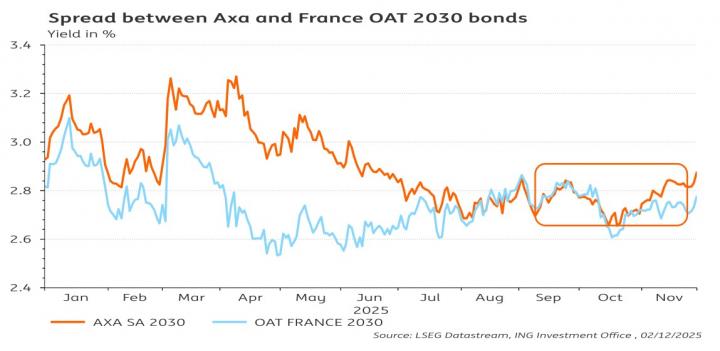

“A peculiar case,” ING economists called the recent evolution of the yield spread between a corporate bond issued by insurer AXA and a French government bond of the same maturity. The yields on both bonds converged, and at certain moments the AXA yield even dipped below that of government paper. Such a negative spread runs counter to the traditional idea that corporate bonds are riskier than government bonds.

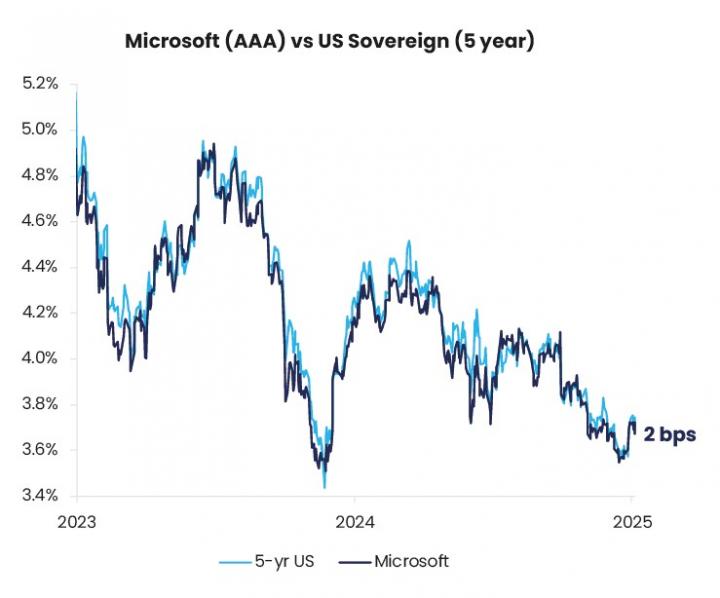

A similar chart emerges when plotting the yield spread between French government paper and a bond issued by the French pharmaceutical giant Sanofi. Asset manager Candriam points out that the phenomenon is also visible elsewhere in the world. For instance, the yield on debt issued by Microsoft is similar to that of US Treasuries.

Safe haven

According to several observers, the convergence is linked to a changed perception of risk: governments are no longer automatically seen as more reliable borrowers than some large corporations.

“Spreads are so compressed because companies are showing more financial discipline than governments,” said Charudatta Shende, fixed income strategist at Candriam. “The fundamentals therefore argue in favor of corporate bonds. While companies have been deleveraging and on average have slightly reduced their debt levels over the past ten years, we see government debt rising sharply.”

Opposite the popularity of high-quality corporate paper stands growing doubt about the safe-haven status of US government debt, given that US debt continues to climb. Still, this should not be overstated, according to Puilaetco chief strategist Ilya Vercammen, because Treasuries have one major advantage over corporate bonds: the enormous depth of that market.

“We do not share the far-reaching pessimism of some regarding US government paper. American exceptionalism may be over, but the US bond market is and remains by far the most liquid. You therefore cannot simply ignore that market.”

Strong fundamentals, high price

How long can the corporate bond party continue? Vincent Juvyns, chief strategist at ING Belgium, still places corporate bonds among the ‘defensive pillars’ alongside gold in the bank’s outlook for 2026.

“Despite low spreads, total returns on corporate bonds remain attractive,” it said. “Corporate bonds retain strong fundamentals: higher yields, short maturities, and lower volatility. The negative risk premiums observed in 2025 could reappear in 2026.”

At the same time, the tight spreads versus government paper are an indication of the recent rush into corporate bonds, making such investments currently “not cheap,” Shende believes. The Candriam strategist urged caution and selectivity. “This could well be the final phase of the expansion cycle for corporate bonds.”

For some investors, corporate bonds have already become too expensive. Insurer AG Insurance, Belgium’s largest institutional investor, believes the appeal of European corporate bonds has diminished significantly and is “slightly negative” on that asset class.

In its own portfolio of more than 70 billion euro, 17 percent is currently allocated to corporate bonds and 45 percent to government bonds, compared with 18 percent and 44 percent respectively at the start of this year. In other words, corporate bonds have not been built up but reduced in recent months.

“While we found corporate bonds attractive until the end of last year, we now see spreads as very low. The compensation we receive for the risk we would have to take is too limited,” chief investment officer Wim Vermeir explained in the insurer’s outlook presentation.

Heightened vigilance is also required because “idiosyncratic risks,” such as a specific company running into trouble, are “omnipresent,” according to Shende. Well-known large US companies such as Ford or Boeing do not exactly have reassuring credit ratings. Should a major name run into financial difficulties, it remains to be seen how such a case would affect the overall popularity of corporate bonds.

Or how the coming months may clarify whether certain corporate bonds can aspire to safe-haven status.