While the average fund in the Global Large-Cap Blend Equity Morningstar category eked out a 5.8 percent gain last year, it was hardly an easy year for investors. Tariff turmoil, geopolitical tensions, and demanding valuations weighed on sentiment.

Offsetting those challenges were AI-driven optimism, strong returns from precious metals and solid performances in European and emerging markets. A depreciating U.S. dollar erased a meaningful share of U.S. equity gains for euro-based investors. Meanwhile, value outperformed growth, and smaller companies once again lagged the large-cap heavyweights that dominated markets.

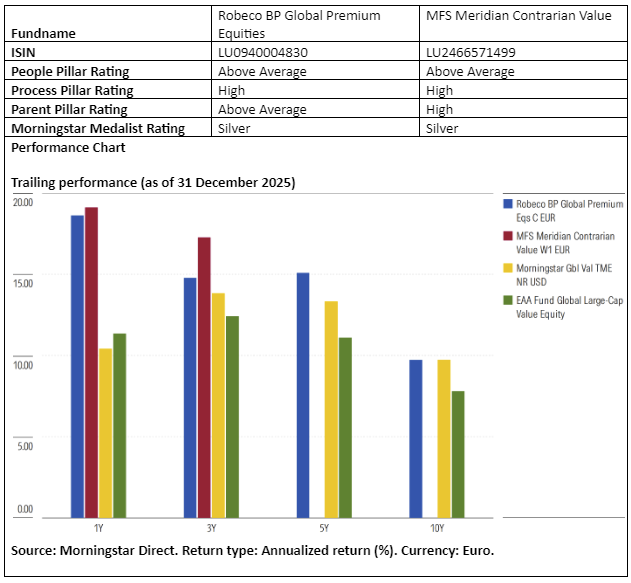

Against this backdrop, we evaluate two strategies in the Global Large-Cap Value Equity Morningstar category that are covered by Morningstar analysts and landed in the category’s top quintile in 2025: Robeco BP Global Premium Equities versus MFS Meridian Contrarian Value.

People

Robeco and MFS exemplify two credible investment team setups, earning them Above Average People Pillar ratings.

Robeco’s approach is anchored by long-tenured portfolio managers with deep, strategy-specific experience. Chris Hart and Josh Jones have worked together for over a decade and have demonstrated consistent stock-picking skill across multiple portfolios. The team was reinforced by the recent promotion of former analyst Soyoun Song to co-manager, which adds sector depth. The team benefits from a well-resourced central research platform of 25 fundamental analysts and eight quantitative researchers, which supports disciplined idea generation and risk control.

Like Robeco’s structure, MFS emphasizes cultural cohesion and platform integration. Anne-Christine Farstad and Zahid Kassam have less standalone portfolio management history, but both are deeply embedded in MFS’ collaborative research model, drawing on a broad global equity analyst network and fixed-income expertise to strengthen bottom-up analysis. Their independent mindset and patience are notable strengths. However, recent turnover and restructuring within MFS’ European research team warrant monitoring, particularly given the strategy’s sizable European exposure.

Process

Robeco and MFS also differ meaningfully in how they translate philosophy into portfolio construction and execution, but both are considered best-in-class, earning a High Process Pillar rating.

Robeco applies Boston Partners’ structured three-pillar framework, combining quantitative screening with rigorous fundamental research. The model balances valuation, momentum, and fundamentals in a disciplined way, helping the team systematically surface attractively priced stocks with improving business trends across the market-cap spectrum. This process provides consistency and risk awareness, reinforced by clear portfolio constraints and broad diversification, which help limit single-stock and sector risk. However, the reliance on model-driven signals can at times temper the team’s willingness to hold deeply contrarian positions through prolonged periods of weak momentum.

MFS, by contrast, embraces a more judgment-led, contrarian process centered on investing in controversial or unloved businesses with a clear margin of safety. The managers focus intensely on business durability, balance-sheet strength, and asymmetric risk/reward, supported by deep fundamental research and a multi-year investment horizon. This approach allows them to lean into special situations and deep-value opportunities at times, making it a bold, conviction driven strategy that requires optimal execution.

Portfolio

Robeco and MFS express their philosophies clearly at the portfolio level, resulting in differentiated but purposeful outcomes. Robeco’s roughly 70-135 stock portfolio reflects a valuation-aware approach that emphasizes reasonably priced, durable businesses while maintaining quality metrics broadly in line with the broader market. The flexibility to invest across regions and sectors has produced a distinct portfolio, with persistent overweights to industrials and European markets such as France, and a pronounced underweight to U.S. equities where valuations appear stretched. Active sell discipline, cutting stocks with weakening momentum and trimming winners as they reach price targets, has contributed to higher turnover historically, which investors should expect to remain above average over a full market cycle.

MFS, by contrast, runs a more compact and overtly contrarian portfolio of roughly 50 holdings, characterized by sizable active bets versus peers and the category benchmark. The managers’ willingness to concentrate in unpopular regions, notably Europe and the UK, and to reach down the market-cap spectrum results in a portfolio with higher mid-cap exposure and a differentiated risk profile. While turnover can be elevated as prices move toward targets, underlying name changes are more measured. Quality is assessed through balance-sheet strength and margin of safety rather than moats, leading to a portfolio that sits between value and blend and reflects disciplined opportunism rather than outright deep-value positioning.

Performance

Robeco and MFS have both delivered compelling long-term results, though their performance profiles reflect their differing styles and risk postures. Robeco’s strategy has produced strong and consistent outperformance under Chris Hart’s leadership, driven by effective stock selection across regions and sectors. Since inception, returns have comfortably exceeded most global large-value peers, with particularly strong results in up markets and solid downside protection during selloffs. The strategy’s ability to balance valuation discipline with business durability has translated into an attractive risk/reward profile and a high frequency of rolling-period outperformance, including a standout showing in 2025 supported by successful European holdings.

MFS’ performance record is also impressive, though achieved through a more volatile path. The team’s contrarian positioning and willingness to invest early in unpopular areas have led to higher drawdowns at times, but stock selection has consistently driven excess returns over a full cycle. The strategy has excelled during recoveries, benefiting from elevated upside capture when sentiment turns, as seen after the pandemic and during the rebound in European cyclicals. While momentum-driven markets such as 2024 posed challenges, the strategy’s strong rebound in 2025 underscores the payoff of conviction-led investing, driven by positions in European banks, mining exposure and a standout performance of Samsung Electronics.

Jeffrey Schumacher is director of manager research at Morningstar Benelux. Morningstar analyzes and evaluates investment funds based on quantitative and qualitative research. Morningstar is part of Investment Officer’s expert panel.