Europe’s fund market is on the brink of a major reshuffle. Under SFDR 2.0, the European Commission’s revised sustainability rulebook, non-sustainable Article 6 funds are set to become the dominant category at the expense of the most popular sustainability category, Article 8.

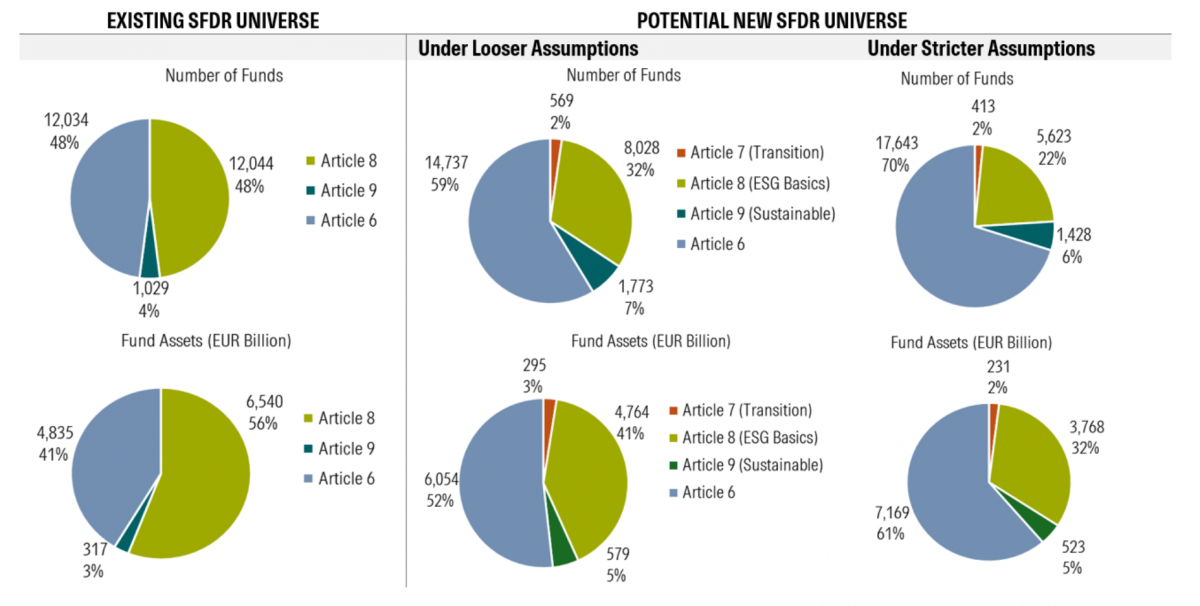

That’s the conclusion of a new impact analysis by Morningstar Sustainalytics, which expects Article 6’s share to jump from today’s 41 percent to between 52 and 70 percent once the new framework is in place.

The shift shows just how drastically Brussels is pruning the current ESG landscape. The first version of the Sustainable Finance Disclosure Regulation (SFDR) produced a maze of labels, annexes and questionable claims. The Commission now wants a cleaner, more credible system, one in which fewer funds will carry the “sustainable” label.

Article 8 as the big loser

The revised system divides funds into three groups: Transition (Article 7), ESG Basics (Article 8) and Sustainable (Article 9). Sustainalytics examined two scenarios and found a sharp decline in sustainability-labeled funds in both. The biggest hit comes to Article 8, now the popular middle category.

As of November 2025, Europe’s fund universe totals 11,692 billion euros across 25,107 funds, according to Sustainalytics. Of that, 6,540 billion euros, or 56 percent, is classified as Article 8. Under the new rules, that share drops to somewhere between 32 and 41 percent.

Meanwhile, the 12,034 non-sustainable Article 6 funds currently represent 4,835 billion euros, or 41 percent of the market. Under SFDR 2.0, their number could rise to 17,643 funds, good for a 70 percent share.

How SFDR 2.0 could reshape the fund universe

Source: Morningstar Sustainalytics, November 2025, excluding money market funds, feeder funds and funds of funds.

Higher thresholds

At the heart of the reform is a strict requirement: at least 70 percent of a portfolio must meet the criteria of its chosen category. That eliminates much of the leeway fund managers have enjoyed under the current regime. The legal definition of a “sustainable investment” also disappears, replaced by a two-page disclosure template meant to aid comparability.

Sustainalytics expects these stricter thresholds to significantly thin out the market. Transition funds remain a niche at roughly 1.6 to 3 percent of offerings. The Sustainable category, former Article 9, grows only modestly, landing between 4.5 and 7 percent. The big uncertainty surrounds ESG Basics, the successor to Article 8. Its eventual size will depend on additional exclusion rules and how supervisors decide to enforce them.

Repositioning

Hortense Bioy, Morningstar’s head of sustainability research, said many asset managers are likely to reposition their strategies over the next twelve months. Some funds will adjust their portfolios; others will mainly update the label. Investors will need to watch closely: a fund becoming “less sustainable” rarely comes with a press release, she said.

Stricter rules may strengthen the market, Bioy noted, but they won’t eliminate the risk of exaggerated sustainability claims.

SFDR 2.0 sets a new foundation, but the fine print is still to come. Technical supervisory standards will determine how the 70-percent threshold is calculated, which indicators count and how consistently national regulators apply the rules. Only then will it become clear how radically the European fund landscape will change.