Europe’s fee war is entering a new phase. Morningstar’s latest European Fund Fee Study finds that while the steepest cost declines are over, new competitive forces are reshaping the industry.

Morningstar analysts said the rise of new fund structures could prove as transformative as the spread of passive ETFs two decades ago. As investors migrate toward transparent, low-cost vehicles, fund houses are rethinking pricing, distribution and product design. Active ETFs, which trade intraday while retaining an active management mandate, are emerging as a bridge between the two worlds.

The implications extend beyond pricing. They reach into the structure of Europe’s fund industry, from the dominance of bank distribution networks to the economics of advice and the role of regulation in enforcing cost transparency.

“Although the pace of fee declines has slowed in recent years, there are reasons to believe the trend is far from over,” Eugene Gorbatikov, analyst for passive strategies at Morningstar, told Investment Officer. “The first is the continued shift of investor capital from active to passive strategies, a movement that shows no sign of reversing. The second factor is the emergence of active ETFs. This wave of new products could spark another round of competitive pressure, similar to the period when the growth of passive ETFs pushed index fund fees lower.”

“Although the pace of fee declines has slowed in recent years, there are reasons to believe the trend is far from over,” Eugene Gorbatikov, analyst for passive strategies at Morningstar, told Investment Officer. “The first is the continued shift of investor capital from active to passive strategies, a movement that shows no sign of reversing. The second factor is the emergence of active ETFs. This wave of new products could spark another round of competitive pressure, similar to the period when the growth of passive ETFs pushed index fund fees lower.”

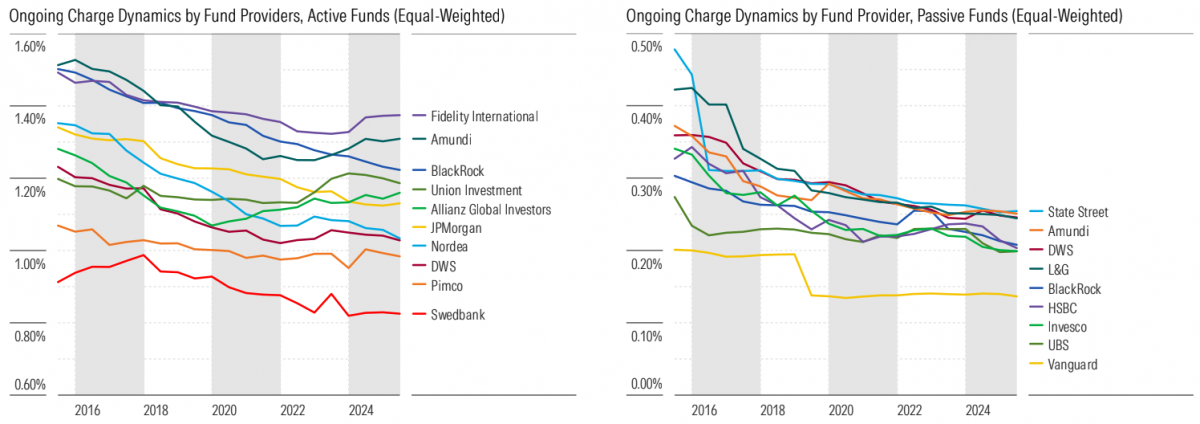

Morningstar’s data show that average fees for active equity funds in Europe have dropped to 1.32 percent from 1.63 percent over the past ten years, while passive equity fund fees have fallen to 0.29 percent from 0.50 percent. Many new active ETFs are launching below those levels, often between 0.25 and 0.50 percent.

“While the trend is still in its early stages,” Gorbatikov added, “it has the potential to reshape fee dynamics once again.”

Structural shift

The shift toward active ETFs comes as fee compression across Europe begins to level off. Morningstar observes that the industry may be approaching a fee floor for passive products, with large ETFs already charging as little as 0.15 percent. That leaves active managers with limited room to manoeuvre unless they adopt new structures that reduce costs and improve transparency.

Active ETFs do exactly that. They bypass the costly layers of distribution that still define much of Europe’s fund market, offering lower-cost access for retail and institutional investors alike. EFAMA’s 2025 Fact Book highlights how scalable fund structures have driven cost reductions across Europe. Passive UCITS now represent nearly 30 percent of total fund assets, up from 11 percent a decade ago, and their influence is increasingly shaping pricing behaviour among active peers.

For Morningstar’s Gorbatikov, regulation is a crucial part of this evolution. “Regulation and competition should not be seen as unrelated forces; rather, regulation plays a key role in enhancing competition,” he said. “Without clear rules on fee disclosure, each fund effectively operates as a small monopoly. By simplifying and standardising fee reporting, regulation increases transparency, prompting funds to compete more directly with one another and often resulting in lower fees.”

ESMA reached similar conclusions in its Costs and Performance report published in January 2025. The authority found that improved disclosure and harmonised reporting are narrowing the gap between Europe and the United States, even as European fund fees remain higher. By boosting transparency and comparability, regulators are creating sharper competition, and active ETFs appear well positioned to benefit.

Undermining traditional models

The rise of active ETFs and greater fee transparency are also reshaping Europe’s fund distribution model. Lia Mitchell, senior analyst for policy research at Morningstar, said that while lower costs benefit investors, regulators must stay alert to unintended consequences.

“While any regulatory change aimed at improving investors’ outcomes via lower costs is welcome, one consideration with a potential ban on commissions is how it disrupts existing business models and any unintended consequences, such as potentially reducing investors’ access to advice,” she said.

“While any regulatory change aimed at improving investors’ outcomes via lower costs is welcome, one consideration with a potential ban on commissions is how it disrupts existing business models and any unintended consequences, such as potentially reducing investors’ access to advice,” she said.

Mitchell noted that both the United Kingdom and the Netherlands have already implemented commission bans, offering a precedent for the rest of the European Union.

“If a ban were to come into place across more EU markets, one would expect a similar effect overall to what has been observed in the UK,” she said. “Any policy changes should carefully consider these types of knock-on effects to ensure the net outcome is an improvement for investors.”

As competition intensifies, distributors reliant on commission-based models are being forced to adapt. Active ETFs, traded mainly via brokerage platforms rather than bank networks, could accelerate that shift by giving investors more control over product selection and pricing.

Partnerships such as Van Lanschot Kempen’s collaboration with State Street Investment Management illustrate this shift. The Dutch wealth manager is using State Street’s infrastructure and ETF expertise to bring its active strategies to market in ETF form, expanding reach without adding new distribution layers. For State Street, the deal strengthens its position in continental Europe while blurring the traditional line between fund manufacturing and distribution.

Italy remains most expensive

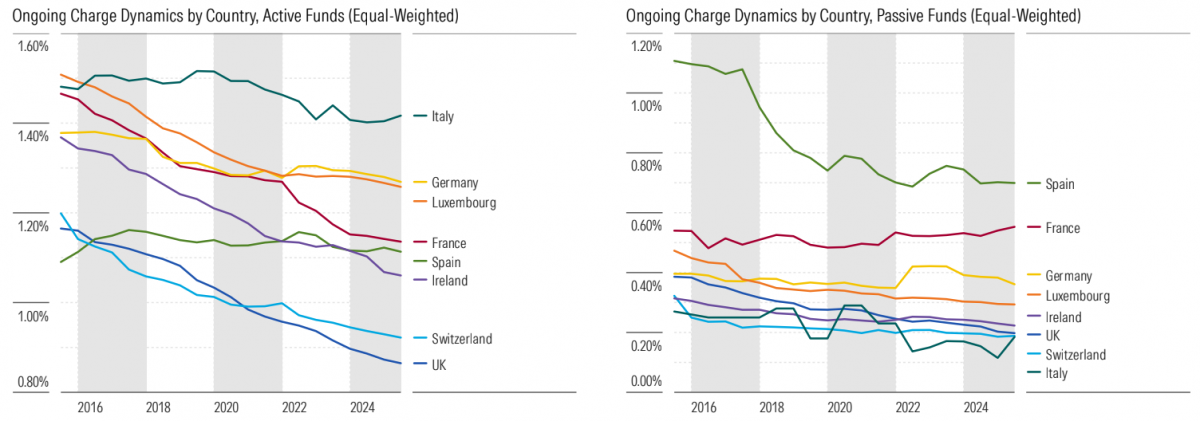

Despite the downward trend, Europe remains a patchwork of pricing. Morningstar’s study shows that investors in the United Kingdom now enjoy the lowest average fund fees in Europe at around 0.9 percent, helped by a commission ban and open distribution. Italy remains the most expensive at about 1.4 percent, where bank-led networks and performance fees dominate.

Fee competition is also intensifying at the private-client level. In the Netherlands, several independent wealth managers now negotiate bespoke discounts well below standard fee tables. According to Investment Officer Nederland reporting, reductions of 15 to 30 percent are common for clients with portfolios above one million euro, while very large accounts can see cuts of up to 90 percent. Market participants said the growing pressure on margins has even led some asset managers to accept contracts at cost price, underscoring how fee compression is reshaping profitability across the industry.

Fee trends by asset manager

Source: Morningstar.

Fee trends by country

Source: Morningstar.