Assets managed through discretionary mandates have expanded more slowly in Europa over the past ten years than assets held in investment funds. That is the conclusion of Efama, the European fund industry association, in its latest sector review.

The European Fund and Asset Management Association maps out the European asset management industry each year. Efama treats discretionary mandates—under which the asset manager receives a mandate from the client to execute transactions—and investment funds as one market.

Total assets under management in Europa (including the United Kingdom) reached 33,000 billion euro in 2024, nearly 12 percent more than a year earlier. According to a preliminary estimate, assets under management are set to rise further to 34,400 billion euro by the end of september 2025.

Shift

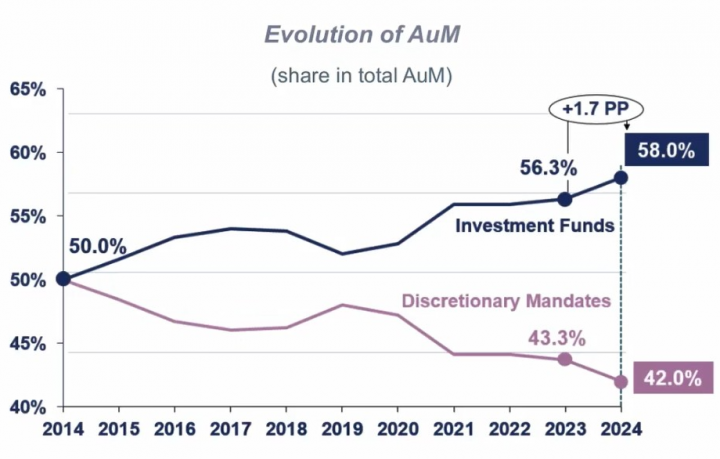

Efama sees a clear trend in the balance between mandates and funds: mandates are losing relative importance. In 2014 total assets under management were still split fifty-fifty. Since then, funds have gained market share year after year. The only exception was 2019, which can be attributed to a change in statistical methodology.

In 2024 funds clearly dominated, with more than 19,000 billion euro in assets or 58 percent of the total. Mandates accounted for nearly 14,000 billion euro, or 42 percent.

Asset allocation

The explanation lies mainly in asset allocation choices, senior economist Thomas Tilley of Efama recently explained in a webinar.

“The declining importance of mandates does not mean that the assets within those mandates have lost value, only that funds have grown more strongly, especially because of the larger share of equities in that category. Listed equities account for 44 percent of the value of funds, compared with only 26 percent for mandates. Thanks to strong equity market performance, fund growth has been solid.”

Mandates, by contrast, contain a relatively large share of bonds—about 45 percent of assets—which lagged behind rising equity markets.

Differences between countries

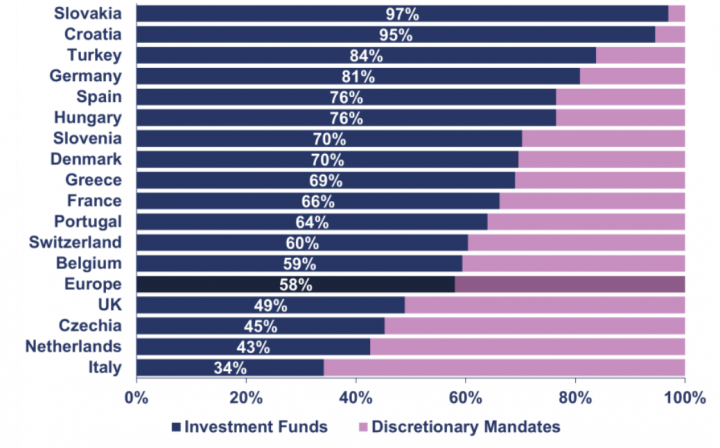

A country-by-country breakdown shows that the European market for mandate management is notably concentrated: 45 percent of all European mandate assets are managed out of the United Kingdom, which appears to have suffered little from Brexit. France follows.

Within the eu, there are large differences between countries in terms of client profiles, complicating unified eu policy. In Belgium, individuals account for 57 percent of assets managed through mandates, whereas in most other eu countries institutional investors dominate.

“Mandates typically require large minimum investments and are therefore far less accessible to retail investors. However, the figures point to the growing success of robo-advisors and online investment platforms, which are making discretionary mandates more accessible to retail clients,” Efama writes.

Netherlands

The balance between mandates and funds varies considerably by country. In Germany, for example, mandate management represents less than 20 percent of the total market, while other member states rely heavily on it.

In the Netherlands mandates even outweigh funds: 1,217 billion euro versus 902 billion euro in 2024. Efama notes: “Since 2020 we have seen several Dutch pension funds convert their investments in alternative investment funds (AIFs) into discretionary mandates, a shift driven by regulatory changes (IFR/IFD).”

Chart: mandates versus funds